As small business owners, we can easily get frustrated when we can’t find the right things for our business. Essential documents, such as receipts required for audits or tax returns, and many more, must be easily accessible. A well-organized bookkeeping system must be in place. Today, I’m going to share with you the key bookkeeping areas to keep organized in your small business. All these areas need to be organized and easily accessible to ensure a streamlined, effective, and profitable business.

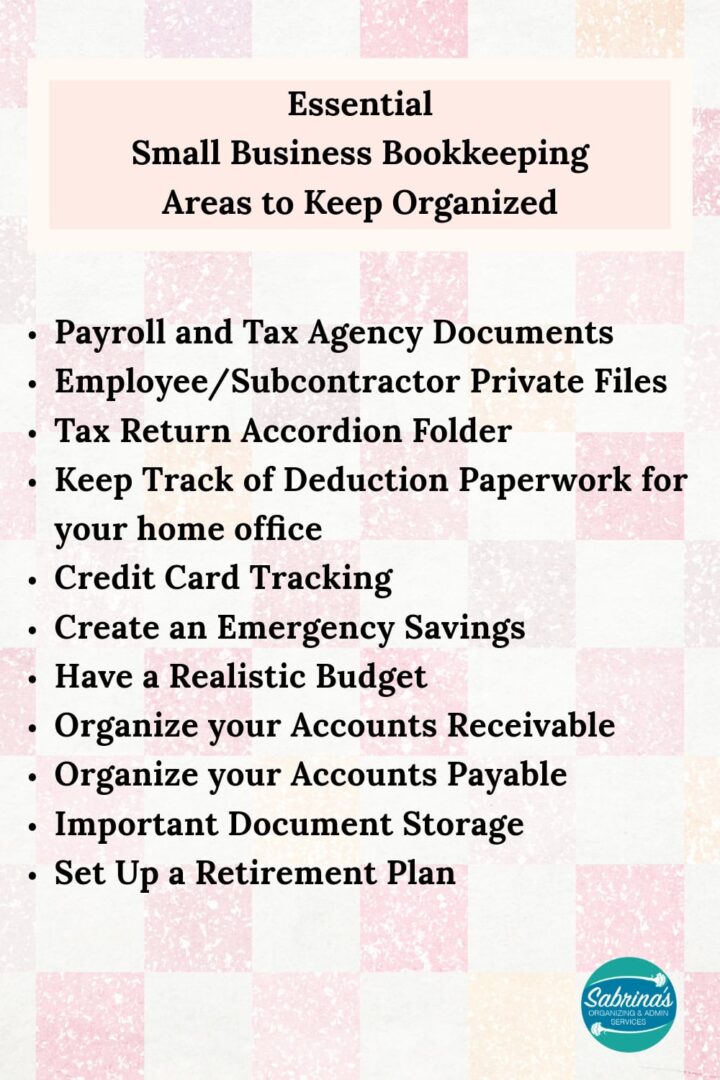

Bookkeeping Areas to Organize

- Payroll and Tax Agency Documents

- Employee/Subcontractor Private Files

- Tax Return Accordion Folder

- Keep track of your deduction paperwork for your home office

- Credit Card Tracking

- Create an Emergency Savings

- Have a practical and realistic budget.

- Organize your Accounts Receivable

- Organize your Accounts Payable

- Important Document Storage

- Set Up a Retirement Plan

Payroll and Tax Agency Documents

First, let’s start with the most important one: organizing payroll and tax agency documents. These papers for the payroll and tax agency must be well-organized and include a designated space for supporting documents, whether you use a digital or paper system. Below are the posts to visit for help organizing your payroll and tax agency supporting paperwork. Binders work best for paper management system. And, a well-organized file structure system works best for a digital system.

How to Make a Digital Bookkeeping Binder

Each business must manage receipts, including bills, confirmation forms, and statements. We have previously discussed a paper bookkeeping binder and how to organize it. Today, we will discuss how to set up the structure of a digital bookkeeping binder.

How to Create a Well-Organized Small Business Bookkeeping Binder

How organized are your small business bookkeeping papers? Are they all in one place, or do you have them in files in a filing cabinet? There are benefits to creating a well-organized small business bookkeeping binder, as I will discuss today. Five Benefits of Making a Well-Organized Small Business Bookkeeping Binder.

How to Make a Well-Organized Business Digital Receipt Organizer

Now that almost all businesses do transactions digitally, it’s a great time to organize your digital receipts. This post will provide everything you need to set up a digital receipts organizer, allowing you to access your important documents when tax time arrives. Learn about why to go paperless and tips on how to start! Digital Receipts

Employee/Subcontractor Private Files

The next area to organize is your employee or subcontractor files. These files should include printouts or PDF signed copies of the agreements you have with them. This should also include other pertinent information. They should be placed in a secure place and updated regularly. I have also included a method to track your 1099 subcontractors, allowing you to easily include them in your files for review. Below are posts I shared to help with these bookkeeping area files.

***2026 YEAR***Increased reporting thresholds: From the One Big Beautiful Bill Act, the new thresholds for Forms 1099-MISC and 1099-NEC: The threshold for reporting payments on these forms will increase from $600 to $2,000 for the 2026 tax year. This threshold will be adjusted for inflation in subsequent years, starting in 2027. – This does not apply for 2025.

Making A Small Business Subcontractor Tracking Sheet

Creating a Small Business 1099 tracking sheet for your 1099s will make your process easier at the beginning of the year for the prior year. This week, we’re sharing how to create a tracking sheet to add to your small business’s end-of-year tasks. First, have a software application and track the vendors. Place all

How To Organize Employee Records in Your Small Business

How do you keep your employees’ paperwork? Do you have one folder for each employee? Or are they all in one folder? Do you know where all your employee paperwork is? Do you have subcontractors? Where are all the sensitive W-9 and W-2 paperwork?

Tax Return Accordion Folder

The next bookkeeping area to keep organized is where you place your support paperwork and your tax returns. Below is the post that explains how to set this up for your small business.

Easy Tips To Be Better Prepared for EOY Tax Return

Each year, we need to review the business papers and place some orders so we can submit them to our accountant, correct? We may have to go through piles and piles of neglected documents and receipts to find those tax-deductible golden copies that will help us.

Keep track of your deduction paperwork for your home office

If you have a home office, you will need to keep track of the supporting receipts when you calculate your home office expenses for the year. This post will guide you through setting up this process and discuss what you can deduct.

Credit Card Tracking

Another area you need to have organized is the credit card tracking. Your credit card accounts should always be reconciled at the end of each month to help protect you from fraud and allow you to review and ensure you are not overspending.

Benefits of Reconciling Your Credit Card Statements

When tax time arrives, do you have your paperwork organized, and are all your statements reconciled? Before you start pulling your bank statements and backup support paperwork together for your accountant for the prior year’s tax return, you should go through and reconcile your credit card statements for your small business.

Create an Emergency Savings

Financial advisors often recommend maintaining an emergency fund for personal use. However, it is also essential to establish an emergency fund for your business. It’s better to put aside a little money when you have a surplus so you have it for a rainy day. Below is a post that will help you with this.

How To Create A Small Business Emergency Savings

It’s no secret that disasters happen even in business. But are you ready for it? How much money do you need in your small business emergency savings (Rainy day fund) to help you in the case of those moments? This question is the one we will tackle today.

Have a practical and realistic budget.

Budgets can be boring, but they can also be quite helpful, as they help you stay on target and even reduce costs on specific items. Below is a post I wrote to help you create an effective budget.

How To Make Your Business Budget More Effective

Effective budgeting is crucial for managing your small business and helping it succeed. Every small business owner needs to review their income and expenses to ensure they have sufficient funds to accomplish their goals and cover all necessary expenses.

Organize your Accounts Receivable

The next area to organize is your accounts receivable. Having a process in place for sending invoices and streamlining their retrieval is essential for maintaining a strong bottom line. Check out these posts below.

Simple Tips to Organize Your Startup Up’s Invoice Process

I was working with a client to set up an invoice system to streamline the monthly invoice process she needed to complete. She dreaded it so much. She would procrastinate for days. This client has approximately 15 recurring clients who bill for random work hours at varying rates from the previous month.

9 Things Every Owner Needs To Know About Accounts Receivable

Everyone wants to be paid for their services, right? We don’t like to call and remind the client to send the check daily. We want our clients to be trustworthy and pay their bills on time. At one time or another, we all have dealt with someone paying late.

Solutions to Help You When A Customer Does Not Pay Your Invoices

Sending out invoices can be relatively easy when all the necessary details, such as client information, account numbers, and other relevant information, are consistent. However, when the client adjusts their company’s accounts payable information, it can be another story.

Organize your Accounts Payable

The next area to organize is your accounts payable. It may be helpful to create a list of all your business bills and their due dates, ensuring everything is organized. Having a valuable place for storing this information, like spreadsheets, gives you a quick look, and you may even find ones that you didn’t know you were still paying, resulting in some money back in your pocket. Feel free to check out my post below about accounts payable.

Important Document Storage

Another area to organize within the spectrum of bookkeeping is categorizing your essential physical and digital documents. These documents include corporate paperwork, a petty cash tracking sheet (if applicable), insurance documents, and many more. These documents will help you determine when to adjust your policy, in case of emergencies, and assist you in saving money. Below is a post that will help you gather these important documents together.

8 Important Business Documents Every Small Business Needs to Find Easily

Let me ask you this question: Do you know where ALL your essential business documents are? These relevant business documents should be stored in a secure location, such as a designated space in your home or office, for easy access when needed. Although you may not access them frequently, it’s essential to have them organized and gathered together.

Set Up a Retirement Plan

Even the smallest retirement planning will help you later in life. This post introduces you to retirement. It’s time to discuss what retirement plan you want to do and how much you want to contribute to it.

Easy Small Business Owner Tips for Retirement Plans

If you think you can’t save for retirement because you are self-employed, think again. A BMO Wealth Management study surveyed 400 small business owners, yielding eye-opening results. When asked how much they have saved for retirement, 75% of them said less than $100,000. But this doesn’t have to be this way.

Organizing all these bookkeeping areas will streamline your steps and help you be on top of all your business tasks.

Now, let’s discuss: what area do you struggle with when doing your bookkeeping tasks? Please leave a comment below.

How can I help you? Looking for small business admin support? Feel free to explore my suite of services, designed to help you streamline your business operations.

Related Posts:

Leave a Reply