How do you keep your employee’s paperwork? Do you have one folder for each employee? Or are they all in one folder? Do you know where all your employee paperwork is? Do you have subcontractors? Where are all the sensitive W-9 and W-2 paperwork? Are they in a secure place? Every small business needs to keep employee records. I have found that several small businesses do not know where all their paperwork is. And if this information falls into the wrong hands, you could be creating undue stress on your employee or subcontractor. To eliminate confusion about which tip relates to which type of personnel, I marked an “E” or “S” at the beginning of each tip to help you organize your personnel files more effectively. The E stands for Employee, and S stands for Subcontractor.

Topics

- How To Keep Personnel Records Organized for Employees (E) and Subcontractors (S)

- E or S: Have an area for essential personnel files.

- E: Store confidential medical records separately from where the basic personnel files are kept.

- E: Keep employee injury (Worker’s Comp.) paperwork in separate folders.

- E: Have your payroll paperwork in a separately organized payroll binder.

- S: Keep Subcontractor invoices in their own folder divided up by year and contracts/agreements in another more permanent folder somewhere else.

- E or S: Create custom forms for personnel.

- E or S: All personnel files are to be secure.

- E or S: Protect your files that are digital with passwords.

- E or S: Create a personnel policy.

- E: Injury files should be placed in a secure area for privacy purposes.

- E or S: UPDATE: Covid vaccine Records

- What Employee Records Do I need to Keep for my Business?

- What documents to keep safe when you have subcontractors

How To Keep Personnel Records Organized for Employees (E) and Subcontractors (S)

E or S: Have an area for essential personnel files.

This would include a resume, W-4 form, copy of job description, benefits records (health and retirement), contracts (salary letters), and any discipline issues paperwork.

E: Store confidential medical records separately from where the basic personnel files are kept.

This will keep you in compliance with the various privacy laws. You can use these Employee personnel files, these personnel records from Smeed, or these employee record organizer folders (from Amazon) to keep your records straight.

E: Keep employee injury (Worker’s Comp.) paperwork in separate folders.

For any injuries, you should have a separate folder with the paperwork related to the employee’s injuries. This will keep it easily accessible if you ever need to refer to this paperwork.

E: Have your payroll paperwork in a separately organized payroll binder.

A binder (affiliate) is excellent because you can hole punch everything and divide it up by tax agency and add a section for employees’ pay stubs. Add a section in the binder (affiliate) for the I-9 employee form for your employees. And, at the end of the year, you can file the whole binder (affiliate) away for safekeeping. My clients (affiliate) really appreciate their payroll binder. Remember, you are an employee, so don’t forget to fill out the paperwork for yourself and store it in the binder as well.

Visit our “How to create a well-organized small business bookkeeping binder” post to get step-by-step instructions on organizing important papers.

Now, onto other paperwork that is needed for new hires.

S: Keep Subcontractor invoices in their own folder divided up by year and contracts/agreements in another more permanent folder somewhere else.

Keeping them separated will minimize the likelihood that an important paper would be missing. I had clients (affiliate) that would constantly lose their agreement with their subs. It was very frustrating for both parties.

E or S: Create custom forms for personnel.

If you have forms specific to your industry for your personnel to complete, keep blank copies in a few “New personnel” packets where you can also store the federal and state forms as well. You can even make a “New Hire Onboarding” folder that contains all the new hire paperwork in it.

E or S: All personnel files are to be secure.

There should only be a small number of people who know where this paperwork is. Filing in a locked cabinet like these below works nicely. If you can find a fireproof (affiliate) one, even better. Check out the filing cabinets below from Amazon if you need a locked one. NOTE: The items below are products sold on Amazon.com; if you click through and buy something, I will receive a small commission at no additional cost to you. Happy shopping! Thanks for supporting my small business.

Lateral filing cabinets work best; they give you more surface space and can hold a lot of files.

Lateral File Cabinet with Lock by INTERGREAT

Buy Now →

Lateral Filing Cabinet by Bush Furniture

Buy Now →(affiliate)

E or S: Protect your files that are digital with passwords.

Now, onto digital files. If you have the passwords digitally, make sure they are password-protected. Make your passwords as strong as possible using capital letters, symbols, numbers, and lowercase letters. Make it unique.

E or S: Create a personnel policy.

Now on to a business personnel policy. Your business personnel policy would include where all the different folders are, who can access them, and when they can access them. If you need help creating your business personnel policy, visit this post: Developing Personnel Policies

E: Injury files should be placed in a secure area for privacy purposes.

If you have injury reporting in your business, you can use a hanging folder called “injury reports” and then have manilla folders (affiliate) inside of it to allow for each employee, their date of injury, and when it was opened and closed.

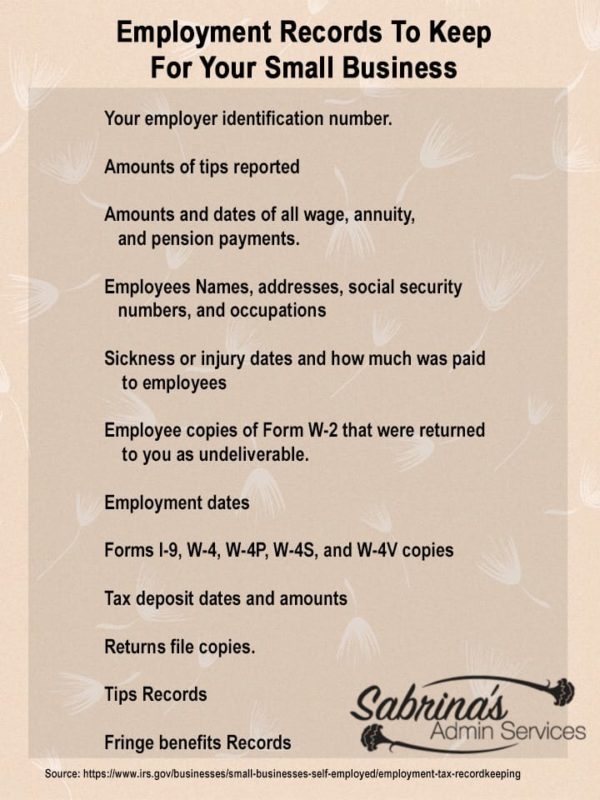

Unfortunately, the IRS does not give you much direction on how to keep this information, so hopefully, this post helps you keep these documents organized. They only list the following for business employment tax records. Visit IRS.gov to get more information. Below is the complete list with a few modifications.

E or S: UPDATE: Covid vaccine Records

If your company has a vaccine mandate, Keep their medical information protected. If you allow a frequent testing option instead of vaccination, test results must be kept confidential as well. The things to keep confidential are employees’ vaccination records, COVID-19 and influenza test results, and related documents secure and confidential. These items need to be kept in a locked area. Read more here from the CDC.

What Employee Records Do I need to Keep for my Business?

Whether you keep these employee records securely digitally or in a safe area in paper form, you will need to organize them correctly. Below is a list of documents you need to keep safe from prying eyes.

List of things you need to keep safe to protect you and your employees.

Your employer identification number.

Amounts of tips reported

Employee Application.

An Employee Contract and non-disclosure agreement.

Employee Handbook.

Amounts and dates of all wage, annuity, and pension payments.

Employees’ Names, addresses, social security numbers, and occupations

Include sickness or injury dates and how much was paid to employees

Keep employee copies of Form W-2 that were returned to you as undeliverable.

Employment dates

Forms I-9, W-4, W-4P, W-4S, and W-4V copies

Tax deposit dates and amounts

Returns file copies.

Tips Records

Fringe benefits Records

COVID Documentation

Keep records from the beginning of employment, and some are kept after the relationship ends. In addition to keeping job descriptions, candidate applications and resumes, interview notes, hiring records, and I-9s, keep records with rates of pay, time cards, payroll and benefits records, and performance appraisals.

What documents to keep safe when you have subcontractors

The list of documents to keep for subcontractors differs from that of employees. Below are just some of the things you need to keep in case of issues.

Independent Contractor Agreements – this should include the scope of work, payment terms, termination clause, and anything else you need to make the agreement clear with the subcontractor.

Contractor License – if they have licenses for your industry

Paid bills from subcontractors – with detailed work described on the bill.

1099 completed forms over the years. 1099-NEC is probably needed. $600 per year is the maximum you can pay subcontractors.

Current Certificate of Insurance documentation. Ask your subcontractor to provide you with this document each year.

OSHA compliant – when hiring a subcontractor in a specific industry, like General contractors, they should be OSHA compliant.

A copy of their Form CP575 letter, which confirms the IRS EIN number on it. Click this link to help you understand what this looks like.

State ID documentation for the subcontractor’s business, depending on the industry.

Workers’ Compensation Insurance – Every subcontractor should provide an insurance binder to their respective contractor. Read more here.

There may be more depending on your industry and the state/local you are in. I hope this list at least gives you a start to gather these documents correctly.

Closing Remarks

After you compile all these areas for your business records, you should keep them for a set amount of time. The IRS recommends employment records be kept for 4 years from when the employee is terminated or leaves the company. So, if the person leaves in 2023, you should keep those records until January 2027. For more information on tips on how long you should keep your business records, please visit my post. I hope this post gives you some guidance on how to make your Human Resources filing system.

If you need help creating your employees’ poandnd/or organizing the physical employee filing systems in your office, we can help! Check out our services here.

Full Disclosure: Below are products sold on Amazon.com; if you click through and buy something, I will receive a small commission at no additional cost to you. Happy shopping! Thanks for supporting my small business.

Hi Sabrina, Coming to you from the Virtual Brainstorming FB group. I absolutely LOVE this article. I’m glad I found you. I’m shifting my business to focus on women entrepreneurs who want to build their leadership skills and create world-class support systems. Your tips here about employment records is SO critical! I know who I’ll refer people too:-)

Thank you for saying that, Tandy. I’m glad you are finding my site helpful.

Sabrina, You are so organized, and so right about your organization of personnel files. I hope to never have to do it again! Lol!

Hi Sabrina,

Awesome list of how to keep records organized and easily accessible especially if you are a small business….less stress.

Thanks for sharing 🙂

This is a great information, Sabrina. By having guidelines from the beginning, your business certainly saves a lot of heartache in the future.

I have to admit that I have one large folder with all the payroll stubs. Periodically I pull out the old ones and do an archive. Since I now only have one employee plus myself. It is not as bad as it sounds. That being said…I will now separate the two and keep them organized

Your website is a treasure trove of valuable information, Sabrina. Thank you.

Being organised and careful with other people’s personal records is important and a huge responsibility. Your tips for what to keep and how to save records are so helpful, Sabrina.

I no longer have employees, Sabrina, but sure with I had this when I did! Great tips.