As a small business owner, you probably have many deductions for your business. But are you taking all the deductions? There are probably deductions you don’t want to make because 1. you don’t have the paperwork to support it or 2. You have paperwork, but it’s so disorganized that you don’t have the time to sort them. To make your life a little easier this time of year, I created this post with business deduction tips to simplify this process.

Table of contents

Use a Software Application to track your accounts.

Tracking and adding transactions into one application works best for everyone: your accountant, employees, and you. Use apps like Freshbooks (affiliate), Quicken, or QuickBooks to track your expense and income transactions.

When buying a Quicken app, be sure to pick one that is for home and business. This will keep your personal accounts organized as well.

In Quicken, create a business category under the new category, then write in the category name and write a brief description to remind you what it is for, and then check the box that says “tax-related category.” This way, when you print out your end-of-year tax report, you will quickly see all the items you have in a lump sum and individual totals.

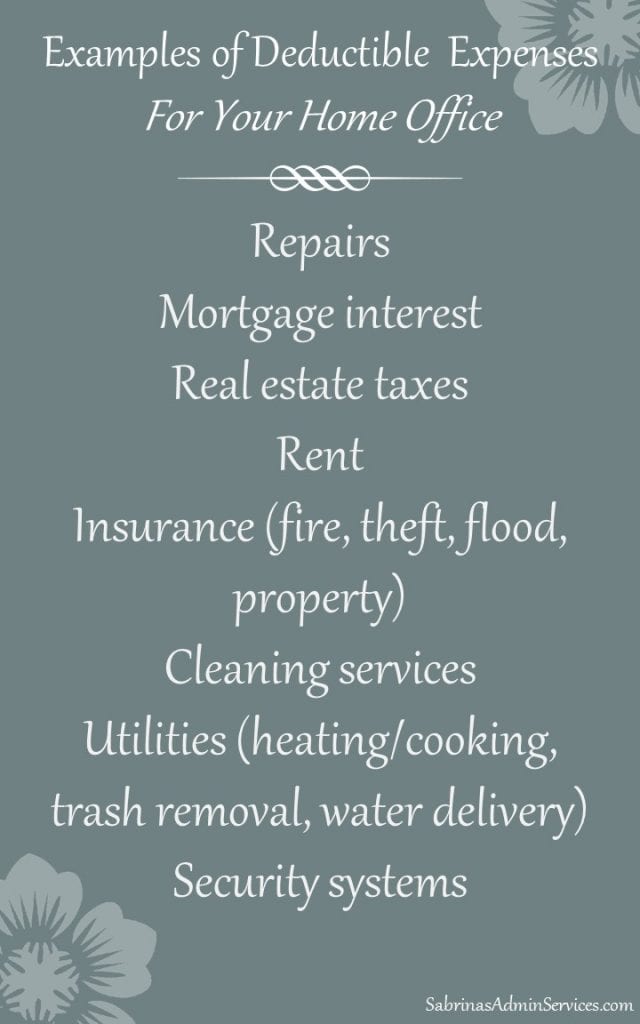

One of the mompreneurs’ biggest deduction mistakes is not taking the home office deduction. Note: You can’t deduct a home office if you have a shop or another place you do business most of the time, however. But, if you regularly use a particular room in your house as an office, you can take advantage of this deduction. Here are some tips on deducting your home office more honestly and accurately.

How do I Keep Track of My Home Office Expenses?

First, gather receipts/transactions that pertain to the home office. Start by gathering receipts for these categories and placing them in folders.

Home Office Expense categories to track

Repairs

Mortgage interest

Real estate taxes

Rent

Insurance (fire, theft, flood, property)—Feel free to divide this into individual folders.

Cleaning services

Utilities (heating/cooking, trash removal, water delivery) – feel free to split this out into individual folders if you like.

Security systems

Along with home office deductions, there is always a question of what you can deduct under home office repairs. Keep in mind that any repairs have to improve your home office area. If you have questions, contact your accountant right before you do a project. They can give you a clear answer on whether the repair is deductible for your business. I have seen many clients (affiliate) who think their repair is deductible come to find out that it is not.

Keep track of the home office repairs in your account register if they are deductible.

In Quicken, add an account for “home office repairs.” Check off the “tax-related category” so it appears on your tax report. Then, when you add repair transactions, use this category. Some home office repairs include painting your room, changing the carpet, installing a door, fixing the floor, and repairing a wall.

Keep supporting documents of what was done in your home office

It’s important to remember that you need supporting documentation, whether digital or paper, for all the deductions you use for your office. These can be paper receipts or digital receipts.

How do I make a Small Business Tax Return Supporting Deduction Organizer?

The best way to keep your papers organized is to create a “Tax Return deduction” organizer just for your business. There are three different options for you below to help you keep track of these transactions. The easiest would be the digital option if ALL your receipts are digital or you have a scanner (affiliate). The two other options take more work and are for paper receipts. Check out the three options below and pick the one that is best for your tax return deduction organizer.

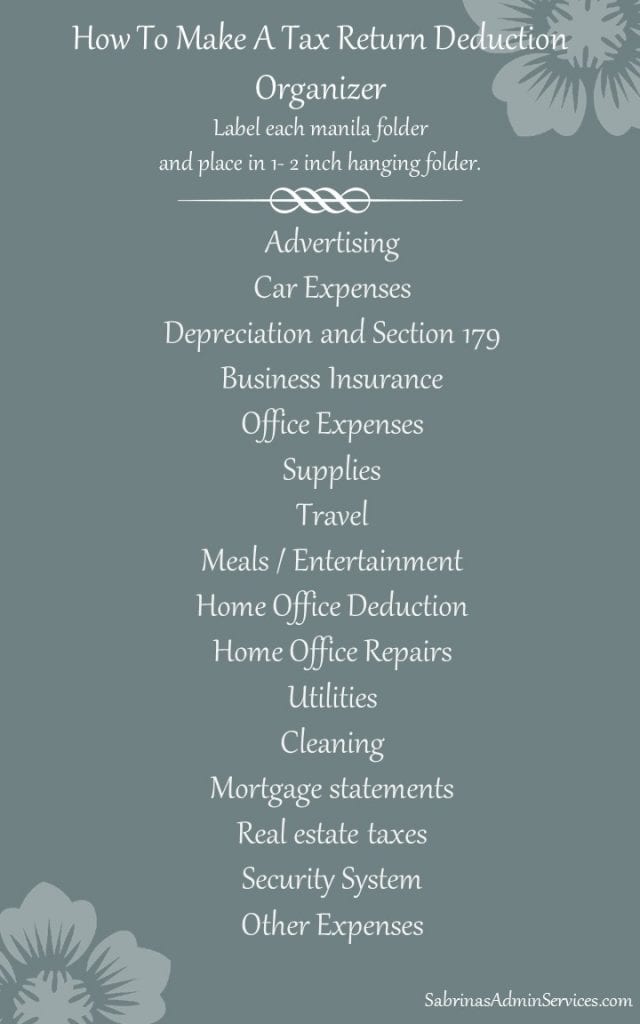

List of Deductions to have in your Tax Return Deduction Organizer

First, remember that for all of the options below, be sure to have a folder for each deduction. Write down one from this list in each folder. If you want individual folders for your utilities, feel free to do that instead of writing “utilities.”

Advertising

Car Expenses

Depreciation and Section 179

Business Insurance

Office Expenses

Supplies

Travel

Meals / Entertainment

Home Office Deduction – see the above section for these tracking expenses.

Home Office Repairs

Utilities – split this out into other folders as needed.

Cleaning

Mortgage statements

Real estate taxes

Security System

Other Expenses

Option 1: Use Manilla Folders

Using a hanging folder, create a folder called “Tax Return Deduction Organizer.” Then, add manilla folders (affiliate) for each item on the categories above. You can add the year to the category label or indicate “current year _______” if you plan on pulling them and placing them into a different accordion folder (affiliate) to bring to your accountant. Pick the best option for you and your situation.

Option 2: Use the accordion folder

If you don’t want to use a hanging folder inside a filing cabinet (affiliate), you could use two(2) 13-tab accordion folders. I prefer the ones that stand up like this one. Then at the end of the year, you can buy a new one and file the entire accordion folder (affiliate) away with your other tax paperwork.

Buy Now →

Buy Now → (affiliate)

Confused about what to keep for your business? Get Your Free copy of my How to Create a Well-Organized Small Business Bookkeeping Binder to create your own Bookkeeping Binder (affiliate)!

Option 3: Digital storage – Where to store digital support receipts?

Another option would be creating digital support receipts folders on your computer. If you prefer not to keep paper bills or invoices, you can make a “Tax Return Deduction copies” folder on your computer for each item listed above. Then, if you have a question or get audited, the digital bills are already organized for you.

Are you frustrated when organizing your receipts on your computer? Feel free to visit my How to Make a Digital Bookkeeping Binder for an example of a structure for keeping your business papers organized.

Check out the links below if you need additional information on your home office business deduction.

Must-Know Tips about the Home Office Deduction by IRS.gov

FAQs – Simplified Method for Home Office Deduction by IRS.gov

Secrets Of Claiming A Home-Office Deduction by Forbes

Well, there you have it. I hope this email helps you keep track of your home office and business deductions to save money $$$$ for your business. Remember, having a system you can use each year will eliminate the guesswork on where you placed a bill or invoice.

Looking for small business bookkeeping services, check out my services here. If you just need help getting your goals and thoughts together, I can help with that too! Visit my Virtual Consulting Services and contact me with any questions.

Related Posts: