Now that almost all businesses do transactions digitally, it’s a great time to organize your digital receipts. This post will provide everything you need to set up a digital receipts organizer, allowing you to access your important documents when tax time rolls around.

Learn about why to go paperless and tips on how to start!

Estimated reading time: 5 minutes

Topics

Digital Receipts Organizer

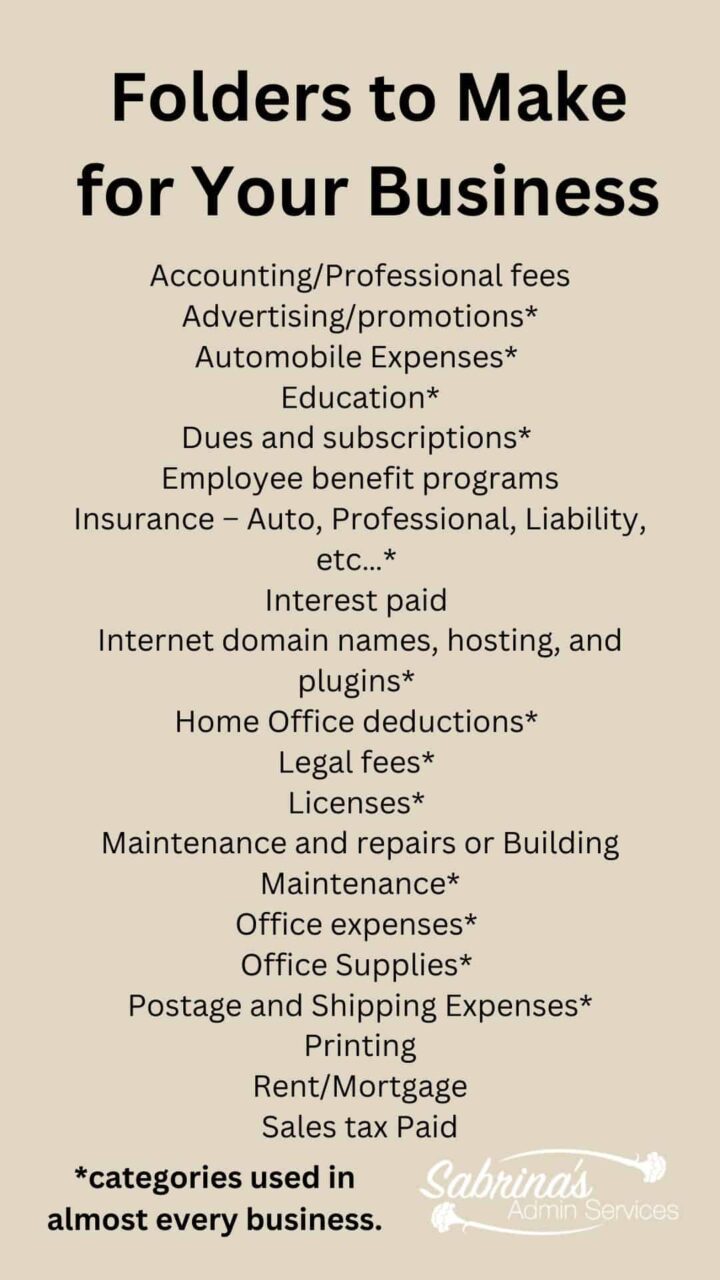

Folders that need to be created for these receipts should be clear and descriptive to help you understand what receipts go in those folders. Titles should be the main categories on your tax return, from deductions (expenses). Below are examples of receipts you may want to organize digitally. Remember that this post is just for digital receipts that may be on your bank and credit card statements and petty cash.

You can consolidate some of these categories’ folders below if you want. I placed an * that shows the ones you will most likely need.

Digital Receipts folders to hold the small business receipts.

Accounting/Professional fees* – you can add the legal fees as a subfolder under this section.

Advertising/promotions* – Making subfolders for different companies you advertise with helps keep this organized.

Automobile Expenses* – make a subfolder for each vehicle if you have more than one.

Education*

Dues and subscriptions* – create subfolders for each association you are a member of under this account.

Employee benefit programs

Insurance – Auto, Professional, Liability, etc…* – have a subfolder for each insurance coverage you have.

Interest paid – you can add this subfolder under the automobile or other loans you may have.

Internet domain names, hosting, and plugins* – create subfolders for each online company you use. You can even add the month of renewal to the filename.

Home Office deductions* – visit this post for details on everything you can deduct in your office.

Legal fees*

Licenses* – adding a subfolder with the new year

Maintenance and repairs or Building Maintenance* – if you have projects that need completing and there are several things you have to do, make a subfolder for each repair project set of receipts.

Office expenses* – create subfolders by the company if you get several from one company.

Office Supplies* – create subfolders by the reused companies. This will keep all the bills in one location.

Postage and Shipping Expenses*

Printing

Rent/Mortgage

Sales tax Paid – this subfolder can hold the confirmation pages you receive after submitting payment.

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

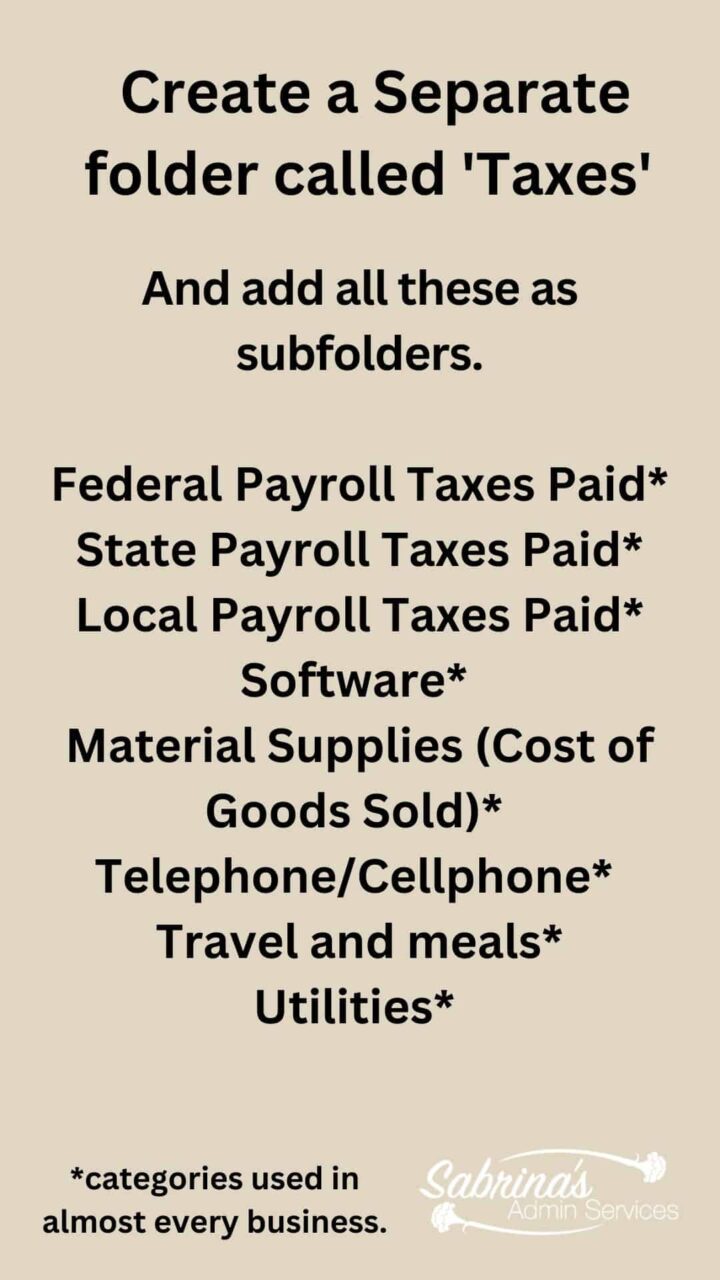

Create a folder called “taxes” and add all these as subfolders.

Federal Payroll Taxes Paid

State Payroll Taxes Paid

Local Payroll Taxes Paid

Software* – adding subfolders to your invoices and correspondences in this folder will keep these items more organized.

Material Supplies (Cost of Goods Sold)* – if you have supplies, be sure to have subfolders for them under this folder.

Telephone/Cellphone* – if you have more than one phone company, have subfolders under this folder.

Travel and meals*

Utilities* – Utilities can easily be placed under Home Office deductions in their subfolder since you need them when you set up your Home Office deductions.

If you want to get a copy of these receipt categories to make your digital folders, feel free to subscribe below. I will give you an easy-to-understand step-by-step way to design your digital files. It is printable, and it allows you to make your very own digital receipts organizer on your computer. I also added additional tips not included in this post.

Digital Receipt Organizer Layout

You are signing up for our newsletter to get a copy of our Digital Receipt Organizer layout from our post “How to Make a Well-Organized Business Digital Receipt Organizer”.

What is the best possible scanner out there?

It is up to you what type of scanner (affiliate) you want to get. Decide if you want to scan several papers at once. Or are you planning on scanning one paper at a time? Do you want to save it to another cloud service like Dropbox? Or will you be scanning them and placing them on an external hard drive in your office? Answering these questions will help you determine the type of scanner (affiliate) you are looking for.

I found that an app works just fine as well. I particularly like the TinyScanner app. It is on Google, and It is on iOS. You can link it to Dropbox and other cloud services. There is a paid version also.

Below are some scanners I found on Amazon (affiliate) (affiliate).

Buy Now →

Buy Now →

Scanner: Epson WorkForce ES-50 Portable Sheet-Fed Document Scanner for PC and Mac

Buy Now →(affiliate)

Disclosure: at no additional cost to you, if you click through and buy something on Amazon (affiliate), I will receive a small referral fee. Thank you for supporting my small business.

Paper Receipts Organizer

If you still want to keep a paper receipt organizer, check out my post, which shares the complete way to organize all your business files physically and digitally.

Did you know that you must keep all credit card receipts related to your business? Visit our credit card receipts post for more tips.

I hope this helps you get and stay organized with your receipts, whether you organize them physically or digitally. Please leave a question comment below, and I will respond as soon as possible.

Learn how to make a Well Organized Bookkeeping Binder (paper edition)

If you need help setting up this receipt system, check out our virtual consulting services, where I can speak with you virtually to set up digital folders customized just for your business.

Feel free to visit our other related posts.

[…] Visit my other posts about how to create a digital receipt system for your business. […]