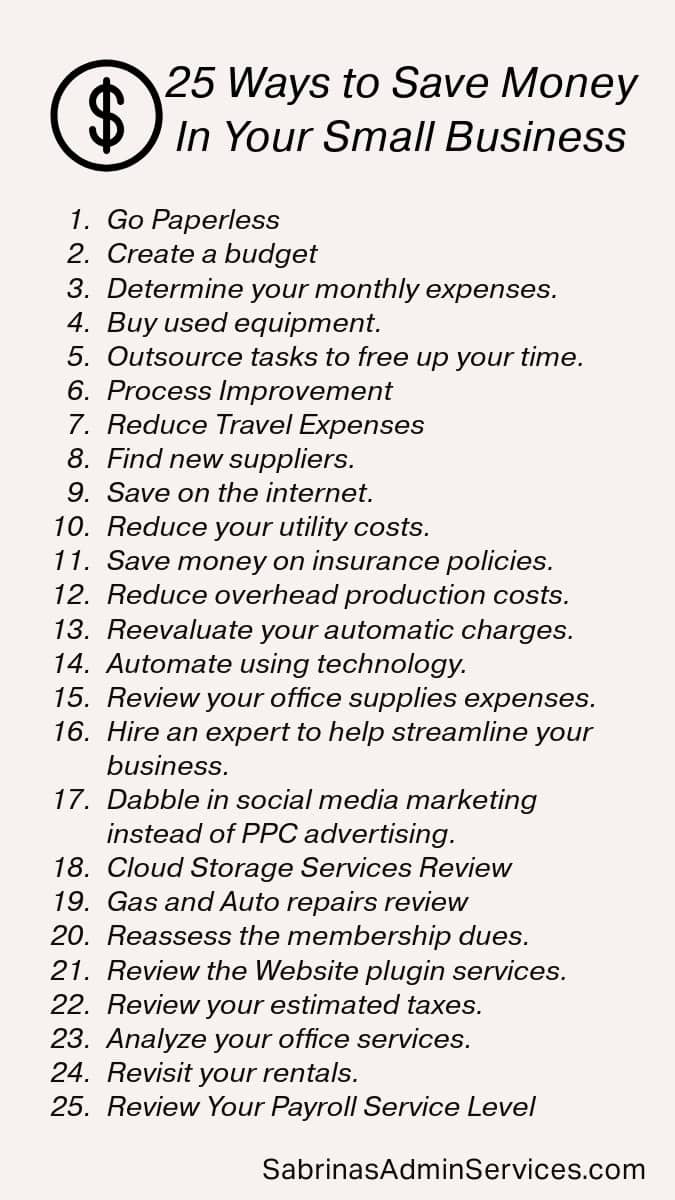

Small business owners must look at every penny when the economy is slowing. Today, I will share how to reduce business expenses this year. Follow along and identify areas where you can reduce costs without compromising quality.

The most significant business expenses in a small business are payroll, technology, and marketing; however, other unforeseen expenses include time wasted on tasks that are not reviewed regularly and recurring charges that are not monitored. The business costs listed below should be examined to determine if they are optimal and will increase your profit margins. We will break down each and share the additional information that may help you reduce your business expenses this year. Let’s begin!

Go Paperless

The first tip to reduce business expenses is to go paperless. You may have done this a while ago when it was all the rage to do it to reduce cost. But, if your business is new and growing, you could be doing things that use more paper than you need. You may find that you no longer need to mail the invoice. Instead, you could email them. Feel free to check out our post that talks about tips on how to go paperless.

Create a budget and determine your monthly expenses.

This one has two tasks: One is to create a budget and the other is to determine your monthly expenses.

If you haven’t laid out a budget for your business, it is a good time to do it. Collect all your expenses into one spreadsheet. With your P&L yearly report, divide the total of each category by 12 to decide what each category’s budget should be each month. Tracking this amount in your business app will show you how you are doing, what expenses are getting out of hand, and where you can save money. Below are instructions on how to set up a budget for different business apps.

QuickBooks Online – How to set up a budget

Quicken – How to set up a budget

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

Buy used equipment

If you need to buy equipment for your business, consider purchasing used equipment to save money on the initial investment. Check out places like CraigsList, eBay, Equipment Trader, and Groff Tractor that may be able to help you find used things.

Outsource tasks to free up your time.

Your time is valuable, so delegating services to independent contractors whose hourly rate is half yours will save you money. You can also visit our other posts about the benefits of outsourcing tasks.

5 Ways to Outsource Work to Save You Time and Money

How to outsource work at your marketing agency

Visit our services for help with your business.

Process Improvement

Time-consuming tasks could be costing you more money than you think. Reevaluating your steps and processes will enable you to do this easily and identify the areas in your business that are most money-intensive. Feel free to check out our service to help 1-5 full-time employees business streamline processes.

Reduce Travel Expenses

If you travel for work, is there a way for you or your staff to do things remotely? Instead of meeting with clients (affiliate) in person every week, how about shifting it to twice a month, with the other week reserved for virtual meetings on Zoom calls?

Perhaps instead of having an office space, you could consider minimizing the frequency of in-person visits or allowing staff to work remotely. Remember that this will only work if your staff is driven and focused.

Find new suppliers.

You may have suppliers you have never worked with before and maybe want to try them out to see how it goes. Sometimes, suppliers will give you lower prices to start with to see if they can provide the same or better level of service as the ones you used. Inquiring about new suppliers’ deals could lead to a brand-new relationship with reduced costs.

Save on the internet.

Revisiting your internet is a way to save if you can access a few different services in your area. You may want to try AT&T or T-Mobile instead of Verizon or Xfinity to see if they can offer you a better deal. Asking many questions to understand the competitor’s service provides is vital to a smooth transition. Here’s a Forbes article that gives tips on how to find a provider.

Reduce your utility costs.

Reducing energy costs can be challenging because it involves reviewing several types of utilities. Electricity can be a significant expense in your office. You can get a free audit from your local electric utility company, not the energy supplier.

You can also ensure that your thermostats are correctly programmed. Reducing the thermostat by 5 degrees can save you money each month. If your business operates from 9-5, consider lowering the thermostat when no one is in the office.

Not all areas of an office need to be lit. Keeping the lights off when the areas are not in use is essential. You can even replace them with energy-efficient light bulbs, such as LEDs.

Ensure that your appliances are ENERGY STAR rated to help keep the cost of running these items low.

Revise Your Business insurance policies.

Contacting your insurance agent to renegotiate your policies is always a good idea, especially every few years. You can reassess various policies, such as professional liability insurance, auto insurance, and renters’ insurance. Increasing deductibles and bundling policies may be options to help you save money.

Reduce overhead production costs.

Not everyone has production costs. However, if you do, reassessing yours could lead to increased savings. Visit this post to REDUCE THE COST OF PRODUCTION.

Reevaluate your automatic charges.

Sometimes, we forget the automatic charges we have on our business credit cards. Visiting our credit cards each month is a good idea to see if any charges are made that we no longer use. It’s essential to review your credit card statement to see all your recurring payments, especially if they are smaller amounts.

Reevaluate your staff’s responsibilities.

When we can’t hire new staff, it’s important to reevaluate what our staff is working on. To save them time and frustration, ask them what occupies their time the most during the day. And, really listen to their answer. They will likely be able to streamline their process with a few modifications. Resulting in less work for them and more money in your pocket.

Automate using technology.

Automation is the name of the game these days. Everyone wants to automate everything. But how much can be automated before it becomes impersonal to the customers? Finding out what your customers want from your company and staff will give you an idea of what other things you can automate instead of your staff’s jobs.

Use AI to speed up your time researching or finding the right words when generating posts. Apps like Hootsuite and Tailwind can help you with this. Just add your and your business’s personality to the content. Don’t go straight with what AI gives you.

Review your office supplies expenses.

Creating an office supplies (inventory) list of products you use and hanging them in the office will help you reduce overspending and increase cash flow. Keep a list of the product names, the quantity required to be in stock, and the source from which you purchase the items. Then, hang it in the office supply area for easy access. Read our post about Office Supplies Organizing.

Hire an expert to help streamline your business.

You can hire a specialist if you identify areas where you may need assistance. For example, you can hire an accountant or bookkeeper if you are concerned about your business books. You can hire a marketer or copywriter if you need help with some ad copywriting. Step back and analyze your business as a CEO to identify areas that lack effective systems. Feel free to check out my services for support!

Dabble in social media marketing instead of PPC advertising.

A social media marketing strategy and steps to help share your products, services, and knowledge will reduce your need for PPC advertising on Google, Twitter, LinkedIn, or Meta. Having a social media scheduler or using Meta Business Suite will allow you to schedule posts for the future.

Cloud Storage Services Review

If you use cloud services like Dropbox, Google Drive, Microsoft OneDrive, iCloud+, etc…, you may want to reassess them to see if they are still crucial for your business. Dropping down or turning them off to a smaller storage size may save you some money.

Gas and Auto Repairs Review

If you have a fleet of cars, gas and auto repairs could be a significant expense. If so, you may want to pull your automotive expenses details from your P&L report for the year and review them to see which vehicle costs the most and decide if there is something you can do to reduce the cost of that vehicle.

When pulling the P&L report for the prior year or two, visit the automotive section to see how much each car costs to maintain. Creating a subcategory for each vehicle under the main automobile category is essential to clearly view this data.

Reassess the membership dues.

Are you a member of several associations? Spending time to see what is needed and what is not may save you hundreds of dollars each year.

Review the Website plugin services.

The next section to reduce business expenses is any website plugin services you purchased. Some services are valuable, and others are not. If you have a blog and use WordPress, you may have some expenses that are no longer needed. Not renewing them will save you money in the short term. Ensure you are fully aware of what the service provides before turning it off and saying bye-bye.

Review your estimated taxes.

The following section where you can save money is your estimated taxes. Try to be as accurate as possible with estimated taxes for your business. Ask your accountant to help you figure out the most precise amount of estimated taxes you should be paying each quarter.

Analyze your office services.

If you have a cleaning service, window cleaning service, or other services, you may want to reassess their importance or reduce the frequency of these services during the month.

Revisit your rentals.

The last way to reduce business expenses is to revisit your rental costs. Are there any items that you can purchase outright to eliminate the recurring rental cost?

Please note that cutting staff is not the best measure to reduce costs. It will damage staff morale, which may lead to unforeseen expenses. Read more about why in this Forbes article.

Review Your Payroll Service Level

When you first purchased your payroll service, they likely placed you in the white glove service, where, if there were any issues, they could assist you directly. However, if you have been in business for a few years and haven’t taken advantage of this service, you can contact them and request that they drop your white glove service.

I hope some of these areas will reduce your company’s business expenses and increase your bottom line. Please share additional tips to help other visitors. I would love to hear from you!

Visit our other Related Posts