While reviewing my client’s P&L report in QuickBooks Desktop, I noticed it lacked a breakdown of the money’s source. This particular client does not invoice through QuickBooks, so the information wasn’t being tracked. I wasn’t going to add more work to the client’s bill to duplicate the invoice process. So, instead, I created a different way to track this information. To save paper, money, and help the client, I made a quick trick to show income breakdowns on the P&L report. Check out my tips and see if it will work for you and your small business. Below, I have also provided screenshots of what it looks like in the QuickBooks Online app.

Topics

My client’s P&L report is more detailed than those of other bookkeepers. What I like to do is create a subcategory name under the Chart of Accounts: Income.

Benefits of modifying your P&L

Here are the benefits of adding a second tier (subcategory) to your Profit and Loss Report.

- When you view the P&L, you can see how much was received from each client, subcontractor, or event.

- Doing this doesn’t affect the accountant totals because the P&L still gives them the total earned sections. It just breaks it out into additional subcategories.

- You do not need to print out a separate sales report to view the total from each client.

- If you do not use invoicing in your QuickBooks account, you can easily view these totals and compare them to your invoices. It’s a great way to double-check your totals.

QuickBooks Desktop: How to add an income breakdown

QuickBooks Desktop: Set up instructions to add a separate account name to P&L

Here’s how I created a subcategory, Income Breakdown, in QuickBooks Pro for Desktop.

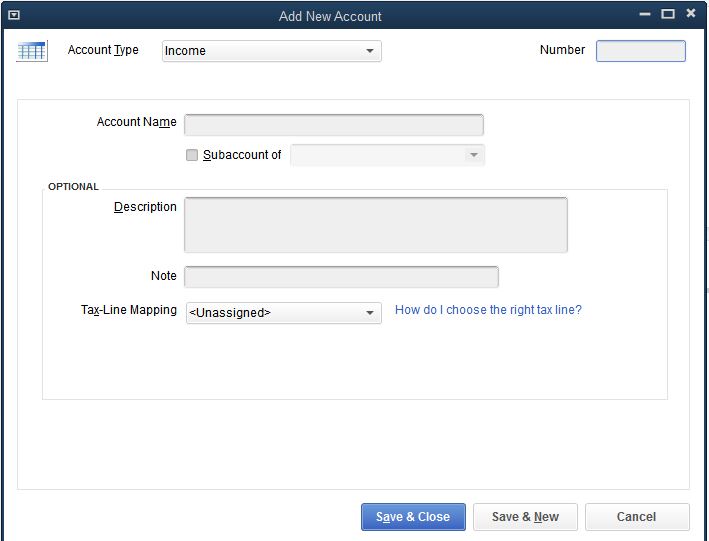

First, I open up an “Add New Account” window in the Chart of Accounts.

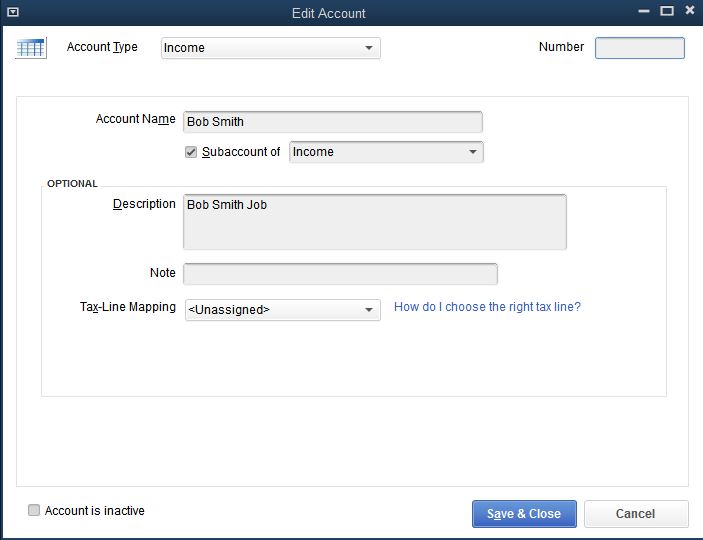

Then, I typed the name of the client or the event in the Account Name area. I ensured it was set to Account Type: Income. Use the event name if you have catering jobs or contracting jobs that you want to track. Check the Subaccount and select INCOME. Then press Save & Close.

That’s it.

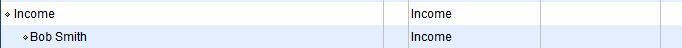

It appears as follows on the Chart of Accounts list.

So, when you enter a deposit in your QuickBooks register, you would select the Income: Bob Smith chart of accounts (or whatever you used) and write the amount deposited. Then, save it and close.

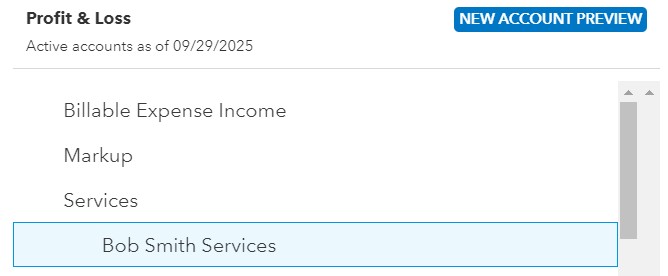

When you view your Profit and Loss Report, you will see this subcategory, Bob Smith, under “Income” split out under the income section. This is also helpful if you want to track subcontractors’ sales commissions to see what they are generating each month.

How to add specific services or people from the QuickBooks Desktop bank register?

Select Banking and make a deposit.

Add the “Received From” name, then the account name (in this case, “Bob Smith”). Fill in the amount and press “Save”.

Always use this account name for deposits to ensure an accurate total for each month and year. It will not duplicate the income. It is just extracting the amounts for this particular person or service.

QuickBooks Online: How to add an income breakdown

Since many people are now using QuickBooks Online, I wanted to add the steps here that show how to create a subaccount for income. This makes it much easier to see where the money is coming from for each employee or service, as opposed to reviewing another report to get more granular information. These steps are ideal for solopreneurs and small businesses with 1-5 employees, as they help them avoid spending a significant amount of time analyzing income numbers each month.

How to set up separate income in QuickBooks Online.

Below are specific instructions for QuickBooks Online.

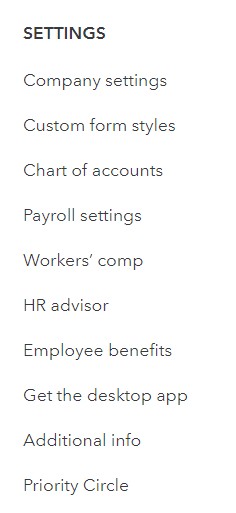

Step 1: Go to the Chart of Accounts, located in the top right corner, by clicking the gear icon.

Under the settings column, select Chart of Accounts.

Step 2: Select New Account at the top right corner.

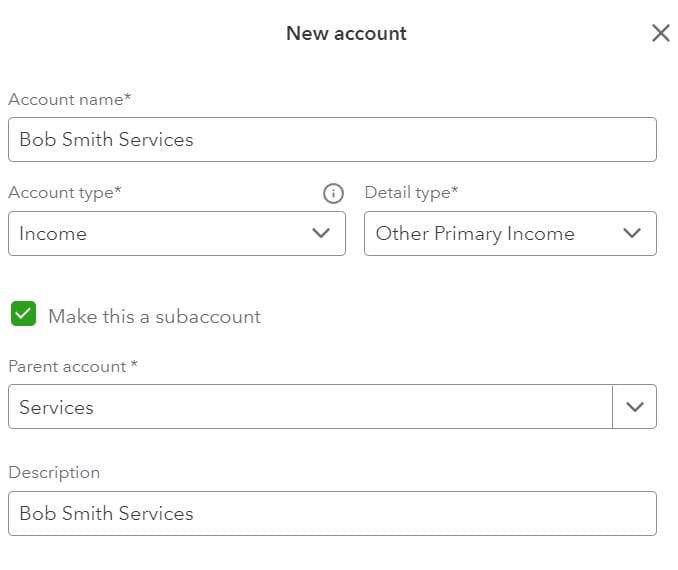

You should see a pop-up that is the “New Account” window.

Write the following information into this section:

- In the Account Name section, enter the name of the person or services you want to track separately. In this example, I am using “Bob Smith Services”.

- In the Account Type section, Select Income, and in the detail type, select Other Primary Income.

- Select the box labeled ‘Make this a subaccount’.

- Then, in the Parent account, select Services or whichever type of income you have as your main chart of accounts for your income. Write a description, like “Bob Smith Services”.

When you scroll farther down the pop-up, you can see at a glance where “Bob Smith Services” will appear on your P&L instead of having to go to the P&L. If it looks like where you want to have it show up, please click the Save button.

What to do when adding to the deposit in QBO?

When you need to add the other services or other employee information,

- Select Banking, and then Make a Deposit.

- In the Ad Funds to this deposit section, fill in the amount received.

- Then use the Account name, in my example “Bob Smith Services”.

- Then enter the description, if any, and the amount.

- Now, press Save and Close or Save and New.

Profit and Loss Report Tips

Here are additional tips for your Profit and Loss Report:

Start adding subcategories at the beginning of the year in your income section so you don’t have to do it throughout the entire year if you know future events that will be happening that you want to track.

Stay consistent with your sub-chart of account names. This will help if you want to compare events from year to year.

I hope this helps you quickly and easily view your breakdown and total income and expenses. Share if you agree. If you need help setting this task up or would like me to demonstrate it personally for your business, please contact me through my bookkeeping services page. Leave a comment or question below if you want to continue the conversation.

Related posts

Visit these posts for other tips on P&L report creation.

How Do I Prepare a Profit and Loss Statement?

Understanding Profit and Loss Reports

Please note the link above are affiliate links through Amazon (affiliate) and at no additional cost to you, I will receive affiliate fees if you click through and decide to make a purchase.

I don’t do my own bookkeeping so I apologize if this is a dumb question. Would it make sense to have income subcategories like “Web design” “Speaking engagements” “One-on-one training” etc.?

If you receive income for Web design, speaking engagements, one on one training and you want to distiquish between them, it makes sense. Remember that this detail is for your use. Your accountant doesn’t necessarily need the breakdown unless your bookkeeper or accountant need to know the total for tax purposes. Some reports are helpful if you only want someone to see part of the picture but being the owner, you can see it all right on one report. Why waste paper? Thanks for asking. I hope this helps.