Staying organized in your business saves you time, money, and sanity. So, whether you are a start-up business owner or have been in business for a while, this post will help you organize your business. Start slowly and focus on each section below to organize your business in 9 days.

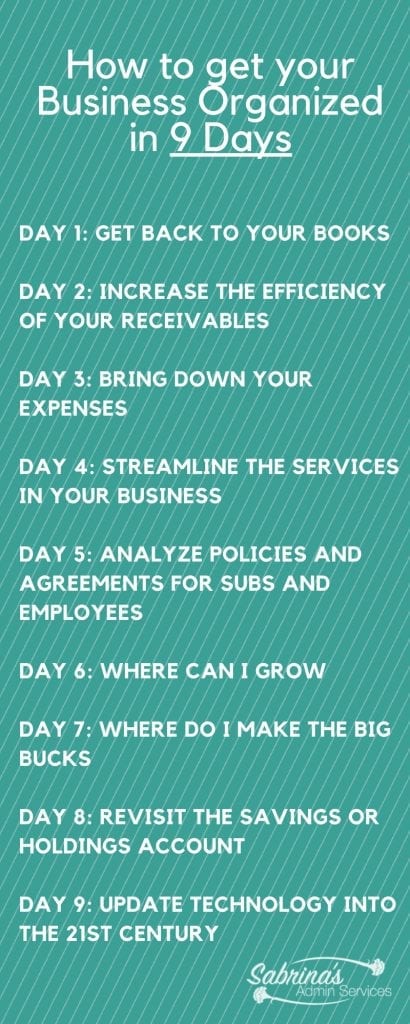

What to do each day

- DAY 1: GET BACK TO YOUR BOOKS

- DAY 2: INCREASE THE EFFICIENCY OF YOUR RECEIVABLES

- DAY 3: BRING DOWN YOUR EXPENSES

- DAY 4: STREAMLINE THE SERVICES IN YOUR BUSINESS

- DAY 5: ANALYZE POLICIES AND AGREEMENTS FOR SUBS AND EMPLOYEES

- DAY 6: WHERE CAN I GROW

- DAY 7: WHERE DO I MAKE THE BIG BUCKS

- DAY 8: REVISIT THE SAVINGS OR HOLDINGS ACCOUNT

- DAY 9: UPDATE TECHNOLOGY INTO THE 21ST CENTURY

DAY 1: GET BACK TO YOUR BOOKS

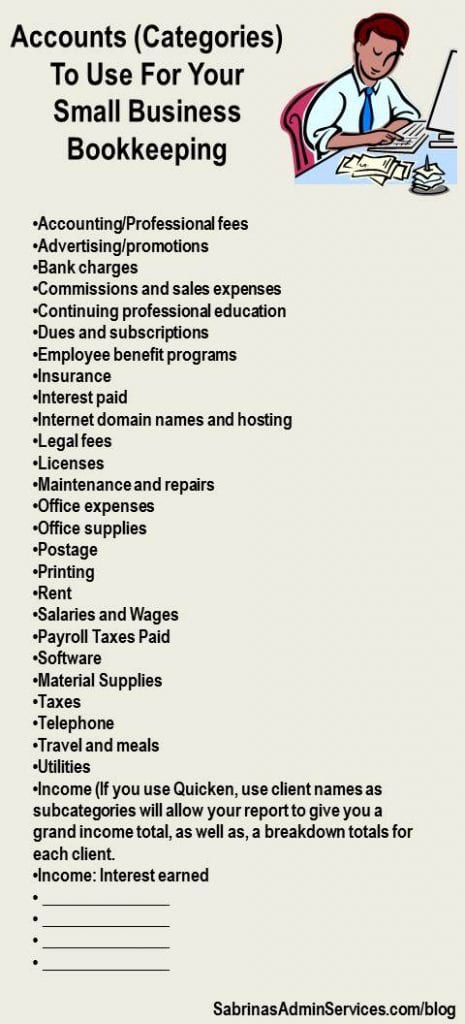

Review your accounts in your register. Make some accounts hidden or inactive so you don’t accidentally use them. By minimizing your accounts to only the essentials, you can easily keep on track even on those days when you are rushed.

Here are examples of a good starting account list for your business. Click on the image to visit the post for details on using these accounts.

While knowing the appropriate accounts (categories) to use is important, there are also other bookkeeping areas to update. Visit 3 Important Things You Need To Know About Data Entry for more essential tips.

By taking the time to update your bookkeeping, you will see what your expenses are. You will also be able to determine your actual income throughout the year. It may seem cumbersome, but you will appreciate it at tax time.

Now let’s ensure you receive your payments on time and not a day late because of an error in your process.

DAY 2: INCREASE THE EFFICIENCY OF YOUR RECEIVABLES

Having a reliable receivables system will keep the money flowing into your business and allow you to save money. Review these areas below for your accounts receivable process.

- Invoicing improvements in QuickBooks. – Have you updated your QuickBooks recently?

- The layout of your invoices. – Does your invoice look like it did when you started your business? Does it help you explain your services or products well? Do you have all the information in it? Does it include any registration number required by your state?

Does it include net days or when it is due? - When an invoice is not paid on time, what is your process? Does this process work efficiently? Are there any steps that you can add to make sure this process works better and quicker?

If you want a new online invoicing service, check out this one from QuickBooks.

Now, on to another important area to get organized. Your expenses!

DAY 3: BRING DOWN YOUR EXPENSES

The next thing to do to get your business organized is to document your expenses. Many small business owners forget what they signed up for and recur monthly charges. Do you do this? It’s very common because they only have so much time in their day this area gets forgotten. Meanwhile, they spend hundreds or thousands of dollars each year not using the service. Visit this area to cut your expenses in your business.

- Review your bills to see what isn’t needed any longer. Do you need that fulling loaded TV service for the break room? Maybe not. Maybe you can drop down to only basic cable.

- Have you reviewed your autopayments lately to see if you use them? Several small business owners forget that they are paying for a monthly service, and years go by not realizing it because they would forget to reconcile their credit card statements.

- Get into the habit of reconciling your credit cards. This task is primarily where your business deductions and general charges are, so keeping them added to your register and categorized correctly will help you at tax time.

Visit Accounts Payable Tips Every Owner Needs to Know post to help give you more tricks to cut your expenses.

We are now through the main bulk of the areas; it’s time to visit the other areas of your business that need to be organized. You may think you are finished, but there are four other areas to organize to truly make your business organized.

DAY 4: STREAMLINE THE SERVICES IN YOUR BUSINESS

Business owners set up systems initially but don’t revisit their processes after a year or two. This is crucial if you want to make sure your business runs at a low cost. Review these areas and posts to help you. Reviewing procedures for each service you offer your clients (affiliate).

Reviewing procedures for each service you offer your clients (affiliate) is another aspect of this streamlining process. By examining the process of a service, you will realize there is a better way to do a task. Which, in turn, will help you save time and money and reduce stress in your life.

Do you document what you do for each of your services? By doing this process, it will show you if steps are unnecessary or if steps need to be added to make the procedure more professional.

Read about why you should do this in our blog post: How to create checklist or procedure lists to improve productivity in your business And, when you want to outsource your workload, you will know exactly what you can outsource.

These tasks may take some time if you are in business for a while, so be patient and work on the different processes one at a time. Now, let’s discuss making sure your employees and “sub” files are in order.

DAY 5: ANALYZE POLICIES AND AGREEMENTS FOR SUBS AND EMPLOYEES

In this section, you will need to analyze policies and agreements for subcontractors and employees to get your business organized. Do you have contacts for all your subcontractors? Do you know where they are? I got this inquiry from several of my clients (affiliate) before we established a better system for retrieval.

Keeping these agreements in a safe (affiliate) space will make it easier to find what you need when you need it. Revisit your policies and documents for your subcontractors or employees. While in this task, it’s a good idea to determine if you need to adjust any payment plans or policies for future employees or subs.

When a start-up business begins, everything is a rollercoaster ride. Some days are good and running smoothly, whereas others are frustrating and will push you to change something in yourself, your business, or your relationship.

Revisiting these agreements will clarify for you and your employees/subs. If you want an agreement or contact layout example, click this link.

DAY 6: WHERE CAN I GROW

How often have you truly looked at the big picture and created a goal for the future? Not often, right? In this task, you will focus on this. Stepping back and figuring out what your business offers and then creating a plan to achieve your goal must be done at least every year. I like to do this BEFORE the new year, so I can plan for the next year.

Answer this question: What business area can you improve to show customers how much you can help them?

This task is not something to take likely; look at it thoroughly. What is working and what isn’t? Determine if they are working for you and your business.

For more information and tips on becoming a Visionary, click this post.

After this mindful exercise, it’s time to see where your income is and if you can let go of any services or products.

DAY 7: WHERE DO I MAKE THE BIG BUCKS

Looking at the big picture is great, but you need to develop steps to get there. Today, you will refocus your energy on areas that make you more profitable and leave the others behind.

Not all areas of your business will make you money. Some services are more expensive to conduct and more stressful than others. Start by assessing the different inflow income services and see which one isn’t making enough to keep going. Then, set up a deadline to stop services in certain areas. Here’s an interesting post about this: Stop Trying to Delight Your Customers

I found that letting go of some services makes room for new and better services. As small business owners, we can do it all. So, eliminating some unprofitable services will allow you to create new ones and be more present with the money-making ones. It’s OK to let go. You have done a great job so far. Take that risk again and move on.

Now that you have eliminated the significant cost services, you can move on to that savings account you have always wanted to grow for those emergencies (rainy days) that happen sometimes.

DAY 8: REVISIT THE SAVINGS OR HOLDINGS ACCOUNT

Emergencies can creep up on a small business owner very quickly. One day you are flying high, and the next, you are pulling money from your retirement to cover labor costs. Creating an emergency fund to hold money from those good years to help those not-so-good years will make your business self-sufficient and help you not have to tap into your personal accounts.

One way to do this is to create an auto transfer through your bank to a savings/holding account. Use the end of each month or determine when the bulk of your invoices get paid and schedule the transfer on that day. Make it an ongoing transfer. If you find that you can save more, adjust the amount. And revisit this auto transfer each year to help you save as much as possible.

If you don’t have an emergency fund, read this post to create one today.

Last but not least, this next area will keep you in the 21st century.

DAY 9: UPDATE TECHNOLOGY INTO THE 21ST CENTURY

How is your technology within your processes? Do you still need to be near your computer to do tasks?

This step is to reassess your on-the-go process to help you be more mobile by using more cloud services to access your information across several platforms.

For collaboration or taking notes on the go, use Microsoft OneNote or Evernote. If you have a Microsoft Office package, you most likely have OneNote. You can share pages and notes via email or through your Microsoft account. Read more about this technology by visiting my post: Microsoft OneNote Notebooks Tips

If you are looking to access files directly from your own server, Western Digital software – my cloud is a great option. Western Digital or other make your own cloud providers are a lot better than the older “keep my computer on to access my files” systems. I prefer to store non-private images and files on the go.

Please note that the above affiliate links are from Amazon (affiliate), and at no additional cost, I will earn affiliate fees if you buy something from the above links.

Well, there you have it. After completing these projects, your business will be so organized that it can adjust as needed. I know it’s a lot, and these tasks can be intimidating. But, if you take it one day at a time, you will achieve your goal of making your business more organized. If you have any questions while going through these processes, please feel free to leave a question in the comment section below. I hope you and your business achieve the success you wish.

Please note the above affiliate links are from Amazon (affiliate), and at no additional cost to you, I will earn affiliate fees if you decide to buy something from the above links.

I’m always struggling to keep up with my bookkeeping, so this article is a great start! I’m going to try to do some of the things listed as part of day 1 on my to-do list.

That’s wonderful, Joanna! We have lots of Bookkeeping tips to help you on this blog. Feel free to check out the Bookkeeping Collection. Thanks for stopping by and commenting. =)

It is a lot, but breaking it down into 9 days – whether we do it on consecutive days or spread out over time – makes it way more manageable.

Sound advice – and we actually used some of it for our own blog business! Thanks for posting 🙂

Thank you for stopping by and commenting.