Bookkeeping has many detailed steps. If you are not a thorough person, this may be a struggle to handle. I have many clients (affiliate) who, when they started their businesses, didn’t know how to manage all the bookkeeping details. And by the time I started working with them, we had to create systems not only for keeping the books, but also for managing the paperwork so that I could accurately record it in the books. This week, we will discuss essential bookkeeping tips for small businesses.

Tips

- Keep your personal expenses separate from your business account.

- Have a folder for each recurring client.

- Use an accordion folder to organize your paper receipts.

- Reconcile your bank and credit card accounts on a monthly basis.

- Digital Receipts and Digital Binder

- Spend time filing your receipts away each month.

- Have one place to store all your passwords.

- Always have an emergency savings account.

- Have a storage area for your important documents

- Closing thoughts

Below are bookkeeping tips for small businesses and solopreneurs.

Keep your personal expenses separate from your business account.

Think of your business as a separate entity. You should minimize the number of personal charges in the account. If you do have to use your company for personal use, be sure to use a “Personal” account name and write in the memo section what it was precisely for. This way, your accountant will know the reason for the personal charge.

Have a folder for each recurring client.

If you invoice your clients (affiliate) more frequently than once a month, create a folder for each client and place only their paid invoices in that folder. That way, at the end of the year, you can see all the invoices each client had for that year. Place them in order from oldest to newest, with the newest on top. Remove any cleared mobile checks from your clients (affiliate) and shred them. Write the check number, amount paid, and date paid on the invoice. You do not need the checks that cleared.

Now that you have settled your paid invoices, it’s time to maintain your books in order throughout the year.

Use an accordion folder to organize your paper receipts.

Create categories such as office supplies, office expenses, Cost of Goods Sold (COGS), auto repairs, etc.

Buy Now →

Buy Now → (affiliate)

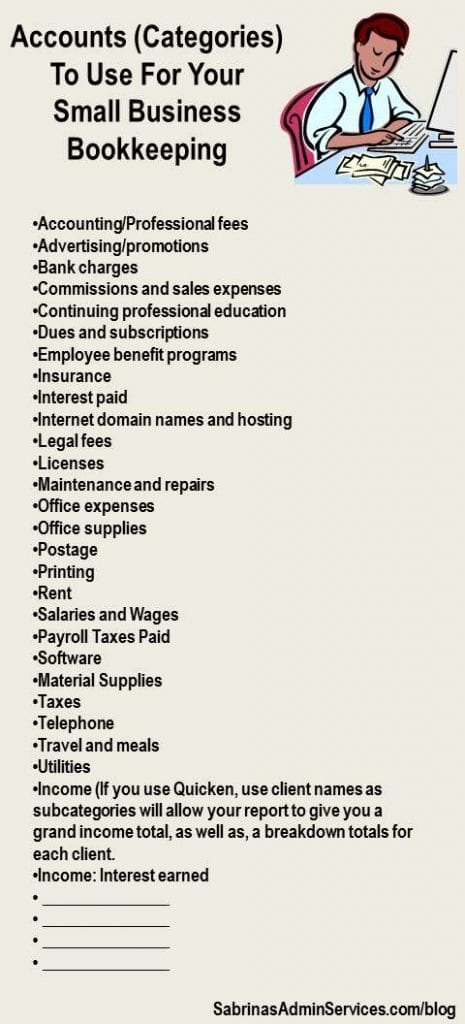

Below is a list of accounts you can use to start. Some may apply and others do not. You do not need to add all of them. Just the ones that apply to your business.

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

Reconcile your bank and credit card accounts on a monthly basis.

Better yet, update your bank transactions on a weekly basis. This way, at the end of the month, reconciling your accounts won’t take you long. Print out the bank statement or have a folder on your computer to store these statements efficiently.

Please ensure that you reconcile your credit card statements monthly. If you have few charges, you can staple the receipts to each credit card statement so you have everything you need if your accountant or the IRS asks about them. Read more in our post: Benefits of Reconciling Your Credit Card Statements.

Benefits of Reconciling Your Credit Card Statements

When tax time arrives, do you have your paperwork organized, and are all your statements reconciled?

Try an Accounting Software

Try using Quicken (affiliate) for Home Business, FreshBooks (affiliate), QuickBooks Online, or QuickBooks Desktop Pro to manage your bookkeeping. Since you can set up downloads, this will save on entering all the data. Ensure that the correct account is selected when you download. The software may not retrieve the correct account, so check carefully before accepting what the bank claims has cleared.

Some software may be more complicated, so try them before buying them. While they usually use the same terminology, some may categorize items in different areas, which can be more complex for some people to locate.

Digital Receipts and Digital Binder

With everyone traveling extensively while running their businesses and accountants handling taxes digitally, it is best to keep all your digital receipts and supporting documents stored on a reliable hard drive or in a secure cloud provider. Feel free to check out my digital receipts processes, which are free ebooks to download and use.

How to Make a Digital Bookkeeping Binder

Each business must manage receipts, including bills, confirmation forms, and statements. We have previously discussed a paper bookkeeping binder and how to organize it. Today, we will discuss how to set up the structure of a digital bookkeeping binder.

How to Make a Well-Organized Business Digital Receipt Organizer

Now that almost all businesses do transactions digitally, it’s a great time to organize your digital receipts. This post will have everything you need to set up a digital receipts organizer to access your important documents when tax time rolls around.

Spend time filing your receipts away each month.

If you set up a well-organized receipt system, both digital and physical, you can maintain it indefinitely, and each year, you only need to relabel folders and files for the current year.

Schedule time to sort through your receipts. A great time to do this is after you reconcile your account. I place them in a bin, and then at the end of the month when I reconcile, I sort the receipts into the accordion folder.

Have one place to store all your passwords.

As business owners, we have numerous passwords, ranging from personal to business ones. Keeping them secure and easily accessible is key to running an effective business.

Find one that meets your needs for both business and personal information. Below is a list of password management apps you may want to check out.

Some additional things to consider when selecting a password manager:

- Look for robust encryption, such as 256-bit AES, to protect your data.

- Additionally, look for secure password-sharing options – this will enable you to share passwords with team members for effective collaboration.

- Some tools monitor password strength and notify you of duplications and weak passwords.

- All of them should provide two-factor authentication (2FA) to protect your accounts.

- Also, ensure that the password manager provider cannot access or manage your encrypted data.

Always have an emergency savings account.

No matter how small your business is, be sure to save at least $ 100 per month to build up your emergency savings account. This will be helpful when money is short and you need to repair broken items. The trick is to set up an autotransfer and forget about it. This emergency savings account needs to grow.

Having at least 3-6 months of emergency savings will help you and your business weather the economic storms. This money should always be in its own savings account, not in your checking account. Feel free to read this article about building an emergency fund from PNC.

Have a storage area for your important documents

Failing to locate the company’s corporate paperwork or stamp is frustrating. Lost checks and credit cards can be annoying and make it difficult to conduct business. Keeping these essential items in one place, secured from prying eyes, will give you peace of mind. Below are our emergency preparedness posts to help you store these items in a safe (affiliate) place.

7 Emergency Preparedness Backup Systems To Have In Place

As I mentioned in an earlier post, September is National Preparedness Month. This post will help you review your backup systems to ensure they are prepared for any potential issues. The summer is a great time to review your office procedures and emergency backup plans. Completing these tasks informs employees on what to do in the

Tips on Preparing your Office for an Emergency

How ready is your office? Is your office ready to be moved at a moment’s notice? With national disasters, small businesses must be prepared for anything. No one wants to be scrambling around trying to get everything they need when they have to leave their office/home. A plan is always a good idea to set

Closing thoughts

It is okay if you haven’t started from the beginning of your business. Just begin in January of the current year to have a complete year of transactions. Before the end of the year, you can catch up with just 4-5 hours each Saturday from now until the end of the year.

When you establish a habit of reconciling and keeping up with your transactions, managing them will be a breeze.

I hope these bookkeeping tips for small businesses get you motivated to get your books in order. If you need assistance, please don’t hesitate to contact a professional. If you need a bookkeeper and want to keep your books clean and easy to read, feel free to contact me.

Feel free to visit our other bookkeeping tips page.

How Long Should I Keep Business Records

7 Ways to Speed Up Bookkeeping Tasks for Startup Solopreneurs

How to Create a Well-Organized Small Business Bookkeeping Binder

Below are some more related bookkeeping posts!