If you need a piece of paper from 10 years ago, how easy would it be to get it? Not many small business owners who have worked for years could say they would be able to find their paper files from 10 years ago. And that is OK. We don’t keep every single piece of paper, though I found while working with several small businesses that not finding that piece of paper gives them undue stress for days, if not weeks, trying to find it.

Table of contents

So, instead of stressing about lost papers, let’s create a better system. Let’s review and revisit paper files each year. Now, I’m not talking about looking at every single piece of paper you have written over the many years you were in business. I am speaking about weeding through (spring cleaning per se) those kept documents you don’t need 5 -7 years after the fact. Pick the files and bins that are most likely on the bottom of all the other bins. This could be papers on your desk (affiliate) below piles of more current pieces. Or, the papers could be in a storage unit you infrequently visit. Even files that are in your basement that you wanted to bring over to the storage unit but forgot.

It sounds like a lot of work, but I am here to make it simpler to complete. If you are still not convinced that you should go through these papers, here are some benefits to convince you that this yearly task is important and will help you and your business.

Benefits of reviewing and organizing your business files each year:

- Make more room in your office or storage unit. If you weed through the papers, you can then reduce the area needed for them. This will eliminate the need for a larger space to store all the documents.

- Save money on folders. Did you know you can turn a manilla folder (affiliate) inside out and use the other side? You can, and it makes it easy and cost-effective to use existing folders for long-term storage. No, need to buy more folders.

- Keeping files from falling into the wrong hands by taking care of them properly. There are numerous files containing sensitive information. Being responsible and properly disposing of these papers will protect you, your clients (affiliate), and your employees.

Now that you know the benefits of reviewing and organizing your business files each year, here are the steps that will help you decide on what to do with each piece of paper. To make this process a success, make a decision and take action! If you don’t make a decision and take action on each piece of paper, it will stay in limbo, which means it will be left out.

Below, I broke down the steps on what to do first, second, and third. Hopefully, this will help you stay focused.

First, decide when you will do this task.

I recommend doing this task during off-business hours. Weekends or late evenings, if you work from a home office. This process will take some time if you need to review a large number of papers. I like doing this while I have a movie on. Time goes quickly.

One cardboard box of paper could take you at least 1-2 hours, depending on its contents and the sensitivity of the material. The more sensitive the material, the more likely you are to have to shred it, which takes more time.

Here is information on the retention schedule for the main types of documents you will encounter. This is from my post called: Ways to Dispose of Physical and Digital Files

Business Files and the length to keep

Employees’ records – keep for 3 years from the termination

Employee earnings records – keep for at least 4 years after termination

Records involving unclaimed property, such as an unclaimed paycheck, check state laws – 4 years after termination

Timecards – keep for at least 7 years

Employment tax records – Keep for 4 years from the date the tax was paid

Travel and entertainment records – Keep mileage logs, receipts, and other supporting documents for 4 years

Then, sit down and pick up one piece of paper at a time, deciding whether to keep it.

Ask yourself these questions:

- Is it over 7 years old?

- Is the paper for payroll? Is it recorded elsewhere, such as in a bank register or your payroll management software?

- Is the paper for employees? Is it from a recent situation?

- Does the paper contain sensitive information? Social security numbers, addresses, credit card information, etc…

- Will the paper be needed in the next year or two?

- Is it backup support paperwork for another document, such as your tax return?

- Is it a business credit card statement?

- Does it display your business bank statement transactions?

These are not all the questions you can ask yourself, but at least it is a start. When you get into the swing of it, it will be easier to decide what needs to go and what needs to be kept.

If no, choose whether to recycle or shred it. Then, finish the action by recycling the paper or disposing of it properly.

If so, now decide if it is truly necessary. Determine why you need this paper and what you need to do with it. If you find you do need it, you can either scan it or store the paper away.

- Store it or scan it? i.e., bills, important correspondence, new mortgage paperwork, general receipts, etc.

- Do you need it for your Tax Return? Pay stubs (to verify when the W-2 arrives), Donation slips, Donation Receipts, Mortgage interest deduction receipts, etc.

Scanning documents best practices

If you do decide to scan the documents, be sure to use standard document settings, with text-heavy documents at 300 DPI, which is good enough for most business papers and reports.

It’s best to have it in PDF format. It is usually shareable, and most people can view PDF versions. You can also save it in TIFF (Tagged Image File Format), but some users may experience issues with this format. Alternatively, you can scan it in JPEG; however, if you need to print it, you may find it challenging and use a lot of ink.

Check out our post on naming digital files below, and I also discuss how to organize folders on your computer.

How to Make a Well-Organized Business Digital Receipt Organizer

Now that almost all businesses do transactions digitally, it’s a great time to organize your digital receipts. This post will have everything you need to set up a digital receipts organizer to access your important documents when tax time rolls around. Learn about why to go paperless and tips on how to start! Digital Receipts

Now, it’s time to get to work.

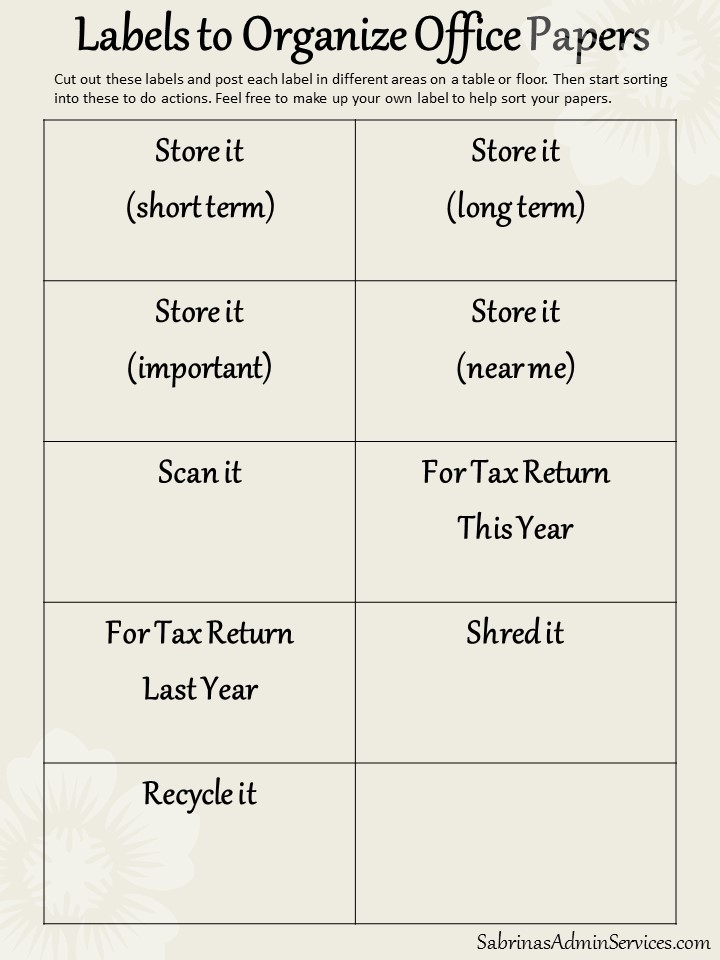

Place each piece of paper in a pile either marked “store it – short-term,” “store it – long-term,” “Store it (important),” “Store it (near me,” “scan it,” “tax return this year,” “shred,” “recycle,” etc…

Cut out these labels and post each label in different areas on a table or floor. Then, start sorting into these “to do” actions. Feel free to make your own label to help sort your papers. Here’s a printable for you to use, or you can make your own.

Next, decide where you are going to store these papers.

- In an archive filing box – label the manila file folder, since it is to be stored away for the long term, you do not need to use a beautiful tag. A handwritten label is excellent.

- In a filing cabinet (affiliate) near your desk (affiliate) or another room- file in a folder with a name on it. Be specific enough to help you remember what the file was for but general enough that you don’t have one piece of paper in the archive file.

- Label the folder. Be specific but general enough to hold more than one paper. The rule of Thumb for filing papers away is: If only one piece of paper is in it, the folder is too narrow. If there is too much paper in a folder, break it down into several more specific groups.

- Use the same system each year—revisit these steps annually to ensure your system remains streamlined.

- Store papers in binders – Documents do not need filing in cabinets. For example, if you pay subcontractors or employees, having a payroll binder organized by tax agencies will help you keep this vast collection of papers held just in case you get audited or there is an error.

While these filing areas are the most common, there may be others that work better for you. Don’t be afraid to think creatively about storage spaces.

Are you still seeking additional guidance? Here are other articles on paper files organizing from me and other experts.

The Art of Filing by Mind Tools

Tips to Organize Office Files – So Anyone Can Find Them

6 Tips for Keeping Effective Filing Systems for the Office

10 Tips For Organizing Your Small Business This Year by Small Business Trends

And, remember, not everything has to be in hard paper files copy filed in folders or archives. You can easily store the less sensitive stuff on a paid cloud service like Dropbox. Read about Cybersecurity for Small Business Owners from the FCC for more information about how to keep digital files secure. By scanning these old pieces of paper, you can eliminate the originals and organize the digital files by topic. Easy peasy!

Well, there you have it. I hope your paper file management process goes smoothly. Feel free to revisit this post in the future for a reminder. If you have any questions about this process, please leave a comment below, and I will get back to you as soon as I can.

Please note these are affiliate links through Amazon (affiliate), and at no additional cost to you, I will earn affiliate fees if you decide to make a purchase.