Whether you are tracking your small business mileage for tax purposes or tracking mileage to bill clients (affiliate), it is essential to keep good records. It’s frustrating and stressful at the end of the year; you miss information because you didn’t track it properly or consistently. Then, you have to track down all the information that should have been tracked all along. I know we have all been there.

Topics Discussed

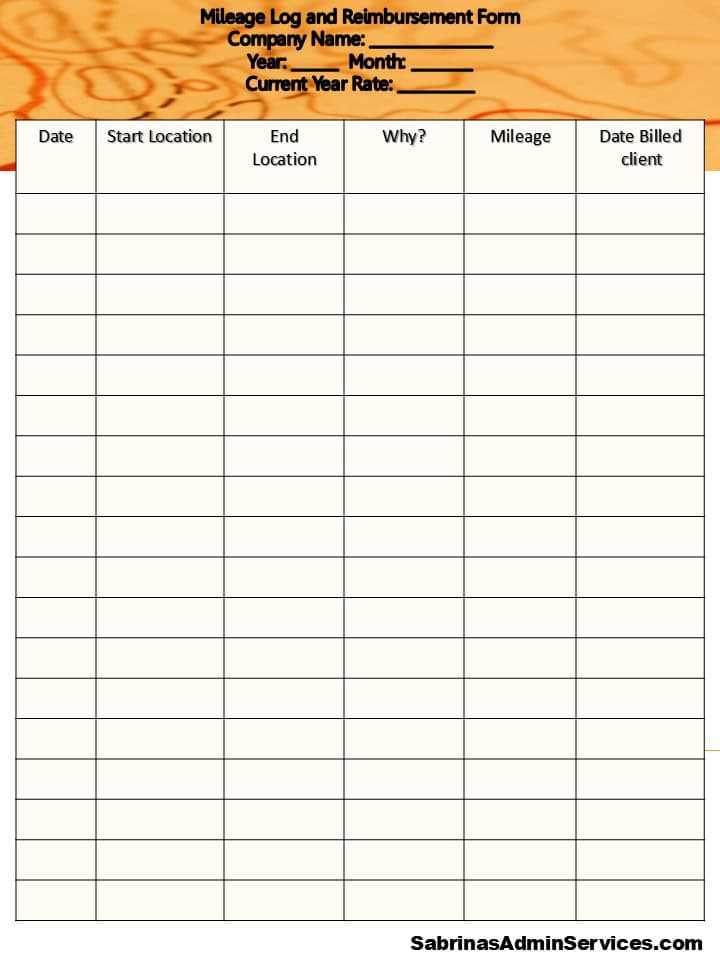

But this year, let’s vow to keep our mileage tracking more accurate by using these easy ways to track mileage for your business. Feel free to use the sheet I created below and print it out each month to keep your records more accurate.

Below is an example of the mileage log and reimbursement form.

How do you use this form to track your small business mileage?

Well, I’m glad you asked. =) Here are instructions and tips on how to use this form:

- Print out copies of this sheet and store them in your car.

- Fill in the top with your company name, year, month, and mileage rate. Here is the current year’s standard mileage rate link from the current year rate is Business: Rates 2025: 70 cents

- Store the paper in a plastic sheet protector in your vehicle(s).

- Write the name of your start location, where you are traveling to (end location), and why you are going to the end location.

- Before leaving, set the trip meter to zero, and write down the mileage you drove when you got to the location under the mileage column.

- If you invoice clients (affiliate) for your mileage, I added a column for you to make a note to remind them that you invoice. I like to use this column and write the dates I invoiced the client so I can refer to the invoice if needed.

- Print out one sheet a month. After the month ends, bring the completed paper into the office and store it safely for tax time.

App tracking mileage Tips

If you want to use an app instead of paper, here are Android and iPhone apps with good reviews for tracking mileage.

Android Mileage Tracker

iOS Mileage Tracker

MileTracker – Mileage Tracker and Reporting

MileIQ Automatic Mileage Tracker

TripLog – GPS Mileage Log Tracker

Mileage Tracker built into accounting software

There are some accounting softwares that have mileage trackers that are incorporated into the app.

FreshBooks (affiliate) – they offer mileage tracking in all their app price points.

QuickBooks – they also have mileage tracking on their app at all levels, from Simple Start to Advanced.

Tips for tracking mileage data

Data can be corrupted and lost, so keeping the information in a second location and doing these other tips will help you keep your data clean and retrievable.

- Try all the apps for your device to figure out which one you want to use. Not all apps may have all the features you want, so take some time to review them before committing to one app.

- If you use the apps, back up your device and files often to prevent data loss.

- Not all apps do a great job of keeping your information. So, be sure to download or print out a paper copy each month so you have the correct backup information you will need if there is an inquiry.

- If you are meeting with a client or coworker and have a meal associated with the mileage trip, write the same information and who you are meeting with in the transactions in your bank register. Consistency is key so if you forget to write the details on the app, you have another place to see the details.

- Revisit your data every month to ensure you have everything you need for the end of the year.

Closing

Whichever method you use, make sure you stay consistent with your record-keeping. Creating a process for filling out the paperwork will help you not forget to fill out the information. And always have a backup plan if anything goes wrong with the system. You can print the weekly mileage log out and place it in a file for safekeeping. Let me know how it goes; I would love to hear from you.

If you want to get more information on travel tips, feel free to visit our other post: Organized Business Travel Tips

Now it’s your turn. Do you use a different app to track your business mileage? Please share it in the comment section below.

Please note that these are affiliate links through Amazon. If you decide to make a purchase, I will earn affiliate fees.

Related Posts