It’s the beginning of the new year, and you feel overwhelmed with preparing for last year’s tax return, right? If you do, start restructuring your system now so that next year’s tax return will be much easier to manage. There are things you can do right now to get ready for a relaxing tax season next year. Let’s begin. Here are three easy tips to get tax returns in order.

Tasks to do now

Please note these are affiliate links through Amazon (affiliate), and at no additional cost, I will earn affiliate fees if you decide to make a purchase.

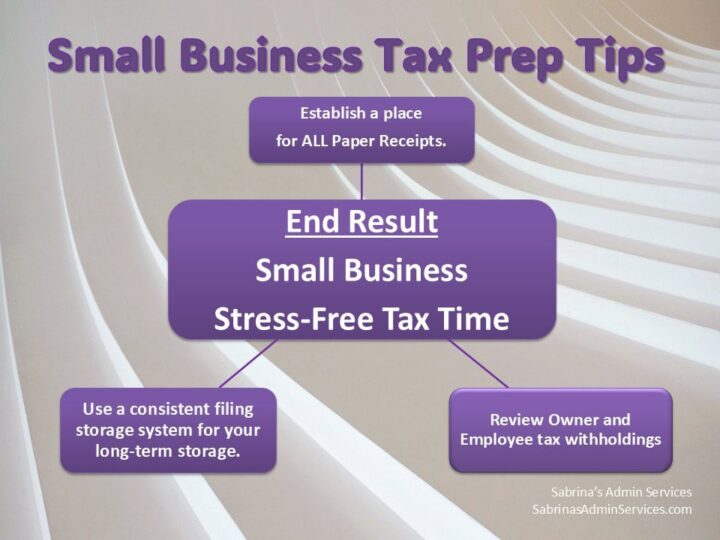

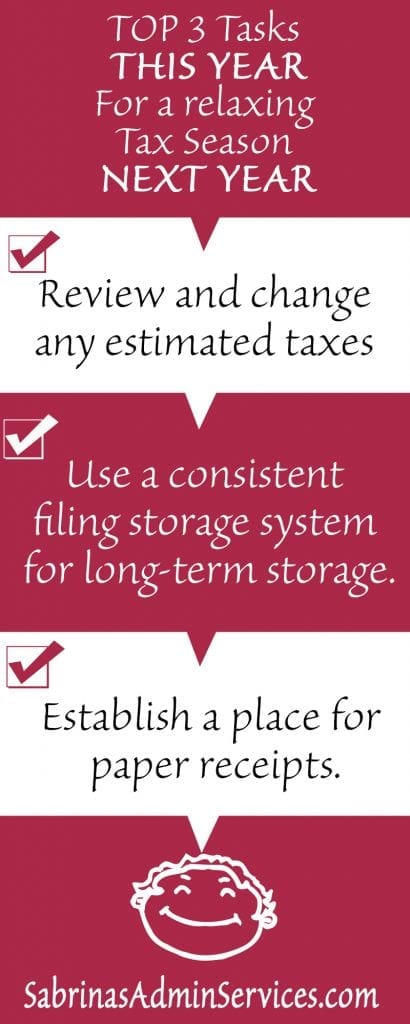

Review and change any estimated taxes that you may need to do for the current year.

Check with your employees and see if they need to have anything changed on their withholding. How about your situation? Do you require more money withheld or less? Some people need to adjust their estimated taxes because their income has changed. This is the time to do it, so you get the right amount of taxes taken out of your pay and, as a result, do not have to owe at the end of the year. Wouldn’t that be great?

Feel free to check out the Estimated Taxes page from the IRS for more details.

Use a consistent filing storage system for your long-term storage.

for your long-term storage.

Where do you put your tax returns after they are completed? Are they all together? Storing last year’s return in a safe (affiliate) place will help you when you need to come back to it next year as a reference. There are several ways you can do this. You can store all of your tax returns in one bin. Or you can save your tax return with your year’s payroll and other receipts. Whichever way you wish to save your tax returns, be sure to stay consistent with the procedure.

Tote with Locking Handles, 18.5 x 14.25 x 10.88 Inches, Clear/Silver

Buy Now →

Fireproof Document File Organizer Box with lock

Buy Now →(affiliate)

Establish a place for your paper receipts.

Label file folders into categories like estimated taxes, accounts payable, accounts receivable, payroll payments, and returns for federal, state, unemployment, and local separately. Sorting your client-paid invoices by customer name if you have several invoices from particular clients (affiliate) will help you verify the amount on your 1099-NEC or 1099-MISC at the end of the year is correct.

Visit our post, How to Create a Well-Organized Small Business Bookkeeping Binder, for tips on creating a paper binder for all these items. It’s extensive, and the system can keep you organized for years.

Additional areas to get organized.

Organize your digital files.

Other areas to visit are your digital files. Making sure your digital receipts are organized and easily accessible is essential. I created a post that talks about how to create the most effective way to manage these digital receipts and statements in this post: How to Make a Well-Organized Business Digital Receipt Organizer

How to Make a Well-Organized Business Digital Receipt Organizer

Now that almost all businesses do transactions digitally, it’s a great time to organize your digital receipts. This post will have everything you need to set up a digital receipts organizer to access your important documents when tax time rolls around. Learn about why to go paperless and tips on how to start! Digital Receipts

Go through and revisit your paid client invoices.

Remove things like checks that cleared and shred them, and make sure you wrote the check paid date, check number, and amount paid on the invoices.

Review the tax summary report or your P&L Statement.

Revisit all the categories in your accountant software (Quicken (affiliate), QuickBooks Online, FreshBooks (affiliate), etc…) to make sure all the transactions you did are showing up for all the deductions you have. Reports you may have are a P&L Report that will show you the cash basis of all your transactions for the year. Alternatively, you may have a tax summary report, which will help you see all the transactions.

Making A Small Business Subcontractor Tracking Sheet

Creating a Small Business 1099 tracking sheet for your 1099s will make your process easier at the beginning of the year for the prior year. This week, we are sharing how to create this tracking sheet to add to your small business end-of-year tasks. First, have a software application and track the vendors. Place all

Helping yourself and your business now will save you time, money, and, above all else, peace of mind.

I would love to hear your tips for organizing your tax-related paperwork. Feel free to leave a comment below.

Feel free to check out my additional posts to help you have a smooth tax season.