This year has been unique for our small businesses, to put it mildly. Since it was so unique, there are business tasks that need to be completed before the end of the year. Today, I will discuss the business areas you need to gather for a seamless tax season. Follow along and get it done so the next year will be more relaxing.

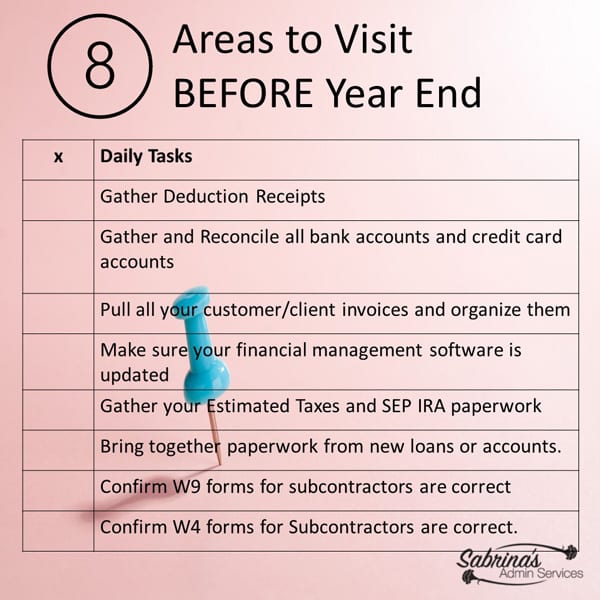

Things to do

- Gather Receipts

- Gather and reconcile all bank accounts and credit card accounts.

- Pull all your customer/client invoices and organize them

- Make sure your financial management software is updated

- Gather your Estimated Taxes and SEP IRA paperwork.

- Paperwork from new loans or accounts

- Run and confirm you have all the W9 forms for subcontractors

- Confirm you have all the updated information for your Employees

Gather Receipts

First, let’s start with the receipts for your small business. Don’t wait to gather these items. The receipts I am talking about are deductible. Visit our post about home office and business deductions for deduction types that will help you determine what receipts to bring together. A Complete Guide to Home Office and Business Deductions

How to Make a Digital Bookkeeping Binder

Each business must manage receipts, including bills, confirmation forms, and statements. We have previously discussed a paper bookkeeping binder and how to organize it. Today, we will discuss how to set up the structure of a digital bookkeeping binder.

How to Keep Business Credit Card Receipts

While reconciling bank accounts is essential, you need proof of receipts for all your transactions, even credit card transactions. Today, we will discuss the importance of keeping receipts for credit card statements and ways to organize your credit card transactions.

Gather and reconcile all bank accounts and credit card accounts.

This may take time if you haven’t done it throughout the year. You can print or save the bank statements in PDF format to leave in a folder on your computer or office server. Remember to gather all bank account statements, including personal ones that may have been used for business expenses. Visit these posts below for more information: 3 Benefits of Reconciling Your Credit Card Statements

Benefits of Reconciling Your Credit Card Statements

When tax time arrives, do you have your paperwork organized, and are all your statements reconciled? Before you start pulling your bank statements and backup support paperwork together for your accountant for the prior year’s tax return, you should go through and reconcile your credit card statements for your small business.

Pull all your customer/client invoices and organize them

As a service business, ensure all your clients (affiliate)‘ and customers’ invoices are gathered and placed in one location. It can be sorted by month if you have a lot of customers. Or, it can be sorted by customers if you have many invoices for a few customers. Either way, it will make it easier to find the evidence you may need in the future.

Make sure your financial management software is updated

Whether you use Quicken (affiliate), QuickBooks Online, or Desktop, or other apps, make sure they are all updated and synced with the bank.

Perfect for Business Bookkeeping for Self-Employed to Small Business with contractors and employees.

Features include Invoicing, Billing and Payments, Expenses, Accounting, Payroll, and more! Try it Today!

If you click through and buy from FreshBooks (affiliate), I will receive a small commission at no additional cost to you.

Gather your Estimated Taxes and SEP IRA paperwork.

You probably have a Federal Estimated Tax confirmation sheet, a state Estimated Tax confirmation sheet, and a Local estimated tax sheet. Additionally, if you have been contributing to your IRA or SEP IRA, you should have all these confirmation sheets organized in one folder for easy access by your accountant.

Paperwork from new loans or accounts

Please pull that paperwork if you have received a new loan or opened new accounts this year. You may need them, and your accountant may also want to see them.

If you purchased a car, you will need to have the information handy to include in your tax return. Be sure to gather them as well.

Run and confirm you have all the W9 forms for subcontractors

Make sure you have all the W-9 forms for your subcontractors. If you plan on doing 1099s this year. Determine if they are non-employees and ensure you use the 1099-NEC form this year. Read about it in our post: What is the 1099-NEC form?

Confirm you have all the updated information for your Employees

If you have employees, you must verify that their information, including legal name, address, and social security number, is accurate. Ensure you have the W-4 form for each employee in their file. If you need help organizing employee records, check this post from our blog: How To Organize Employee Records in Your Small Business.

If you have employees on payroll, ensure that all information and totals for each employee, including yourself, are accurate on the Payroll Summary and how they appear on a W-2 layout.

When you get all these items together, you will be ready for the end-of-year tax return that every business owner will be doing. I hope that getting these business tasks together will help you have a more peaceful tax season. Feel free to leave a comment or question below. We would love to hear from you.

If you click through and make a purchase on Amazon (affiliate).com, I will receive a small commission at no additional cost to you.

Below is some additional information I found online to help you with the business tasks to do at the end of the year.

End-of-year checklist for small businesses

Related Posts

1