Reviewing your small business accounting files and reports is crucial to the success of your business. While we may feel scared or uninterested, it is an important task that will help you understand the direction of your business, where money is going, and where to save, as well as identify any fraudulent situations and misused funds, resulting in overlooked deduction items. Today, I will outline the key review periods for various financial reports and other tasks throughout the year. Follow along and review business bookkeeping reports to make your reminder appointments today.

Review these business bookkeeping reports

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

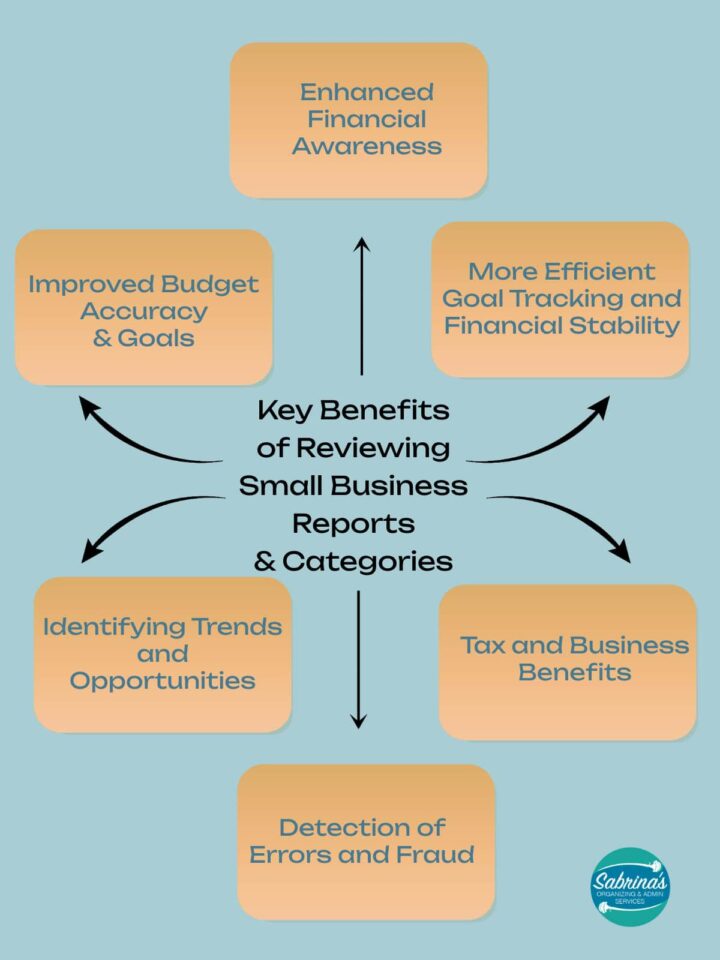

Key Benefits of reviewing your business reports and categories

Reviewing the financial report is essential for any small business. Below are the key benefits of reviewing your reports regularly to track your business’s progress.

Enhanced Financial Awareness

When you review and assess your financial data, it will provide a deeper understanding and help you be more realistic in evaluating your business. This awareness enables you to identify where your money goes versus where you think it goes, often revealing surprising insights about your financial habits.

Improved Budget Accuracy & Goals

After a year in business, reassessing your categories and accounts in your accounting software will make them more accurate and help you see how your company has progressed. Regular reviews enable you to modify these categories, merge similar ones, or split broad categories into more specific ones, helping you understand your expenses and determine your business model goals more precisely. This results in more accurate budgeting and better financial forecasting.

Identifying Trends and Opportunities

Reports reveal trends over time that might not be obvious from day-to-day transactions. You may find that certain purchases happen at certain times of the year. And, you will see gradual increases in certain expense areas as well. You can see recurring expenses more clearly. Examining these areas helps you make proactive adjustments rather than reactive ones.

More Efficient Goal Tracking and Financial Stability

Whether your goals are to reduce dining-out expenses, increase rainy-day funds, or more accurately track business travel costs, keeping categories more specific and aligned with your objectives will provide a clear view of the details at a glance. You can quickly see if you’re on track or need to adjust your approach.

Tax and Business Benefits

Helping your accountant see your expenses more clearly will make tax time less stressful. Accurate categorization ensures that you don’t miss deductions and makes tax preparation much smoother. Regular reviews help identify and correct any miscategorized transactions before they become issues during tax season.

Detection of Errors and Fraud

Lastly, reviewing reports regularly helps you identify unusual transactions, duplicate charges, or potential fraudulent activities more quickly.

The key is to make this review process routine, rather than something you do only when problems arise. Even a monthly 15-minute review can provide valuable insights that improve your overall financial health. To make your business and life easier, I have subdivided the review Business Bookkeeping File tasks into weekly, monthly, mid-year, quarterly, and yearly categories.

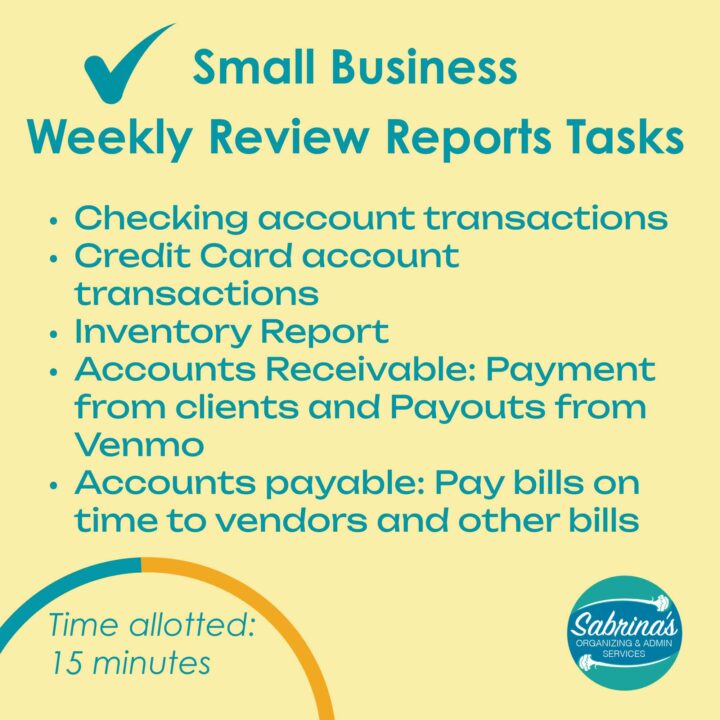

Weekly Review

The weekly tasks are beneficial for keeping close to the transactions that have just occurred.

Checking account transactions – if you do not check your account once a week, this is the time to ensure all transactions are categorized correctly.

Credit Card account transactions – Make sure that all your cleared transactions are in your credit card account and in the correct category (account) to maximize your deductions.

Inventory Report – Track your inventory to determine if you need to replenish any items.

Check out our post about how to create an expense tracking sheet for solopreneurs.

Accounts Receivable/clients (affiliate)/payouts from Venmo – Have you billed all the invoices to your clients (affiliate) this week? Visit the receivable aging report to see if any clients (affiliate) have not paid their bill on time (overdue accounts).

Accounts payable/Vendors/Bills – Have you paid all the bills that are due this week?

How much time does reviewing this section take?

The time it should take to complete these tasks should be approximately 15 minutes, once a week.

Monthly Review

The monthly financial reports are designed to review your progress toward your goal. Analyze trends that may have changed, reduced/increased. Below are some reports to review each month to help you.

Profit and Loss Statement (AKA Income Statement) – Review your line items to ensure they include all transactions for that month and are accurate.

Balance Sheet – This report doesn’t change significantly, but it will allow you to see what hasn’t been paid yet, such as sales tax collected and payroll liabilities that have not been settled.

Advertising – Return on Investment – Assess the costs and the value you received from your advertising efforts. Check website traffic, lead generation, conversion rates, etc…

Bank account reconciliation and transaction reports – While reconciling your bank accounts, review the categories to ensure they are not too broad.

Sales Report – Reviewing how you did for the month and comparing to your prior year or that month for the previous year. If you have clients, you may want to visit your Income by Customer Summary report to see details for each client.

How much time does reviewing this section take?

These tasks may take you approximately 1-2 hours to review, depending on the complexity and activity of your business on a monthly basis.

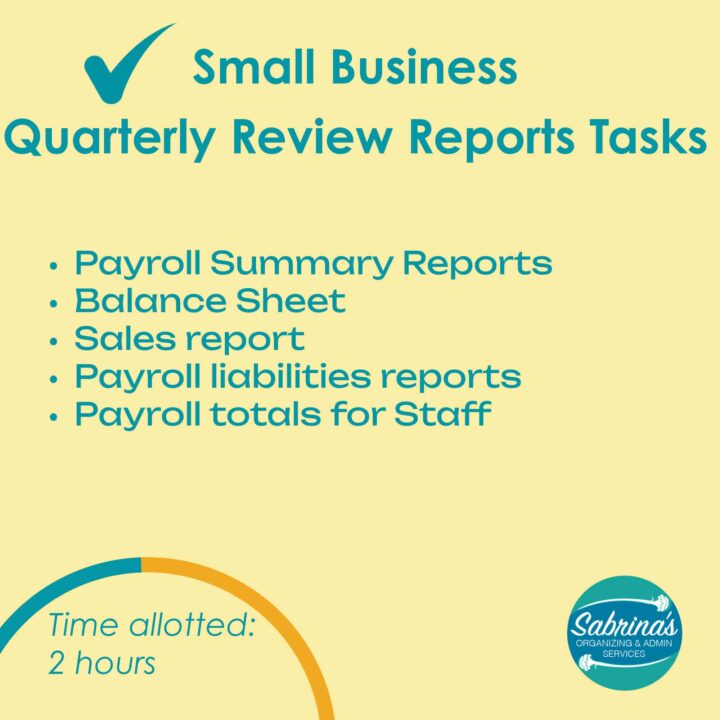

Quarterly Review

It is essential to review the reports below about your year-end goals and financial strategy. Are all these areas on track with your business direction and growth?

Payroll Summary Reports – Go in-depth with your cash flow report information and ensure your expenses are used consistently. Usually, reports can be easily responsive, and you can click into the transactions to dig deeper and access a list of categories.

Sales report – You may want to visit this report on a monthly, quarterly, and yearly basis.

Payroll liabilities reports – if you have quarterly payroll to pay, you will need to review this report.

Payroll totals for Staff – It is essential to review your end-of-month staff totals to stay on top of your business expenses.

Check out my post called: how to make a quarterly checklist for your business.

How much time does reviewing this section take?

Assessment of these tasks could take about 2 hours.

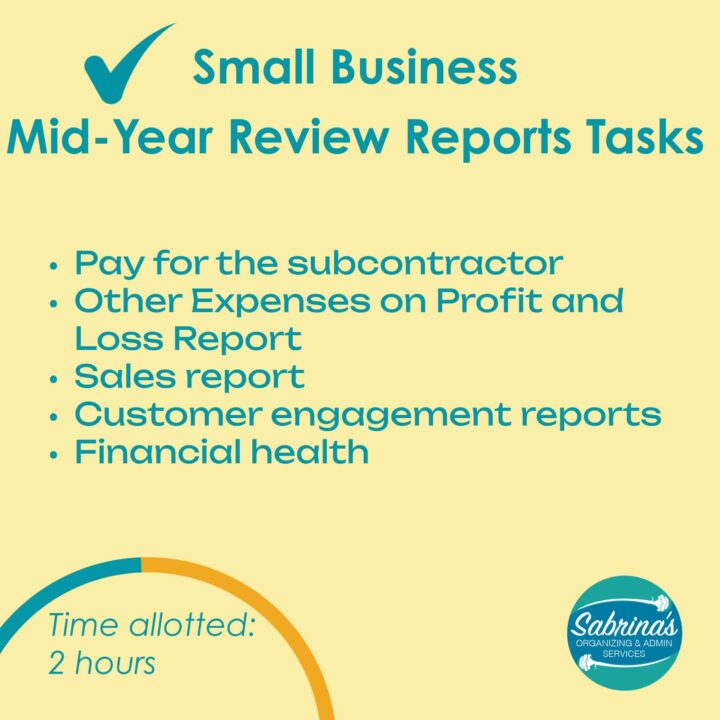

Mid-Year Review

Mid-year reviews are ideal for evaluating your progress toward your goals.

Pay for the subcontractor – assess the subcontractor’s totals for the year so far and project what you will most likely pay them for the entire year. Determine if it is too much or too little, and if adjustments are needed.

Other Expenses on Profit and Loss Report – Dig deep into specific categories and review the particular transactions to ensure they are categorized correctly.

Sales report – If you have salespeople and customers for services, checking revenue specifically from customers will help you determine the average sale value and customer acquisition cost. These reports will help determine how your sales staff is performing and who is generating new deals.

Customer engagement reports – Customer satisfaction is essential to know, as it helps determine your retention rate and whether the same customers or new ones make repeat purchases. If there are any issues, you can easily pivot and make changes to improve your bottom line.

Financial health – Visiting overall Profit and Loss statements, among other statements of operations for the first half of the year, will give you a better understanding of your profit margins, cash flow issues, and outstanding debts.

How much time does reviewing this section take?

These tasks should take about 2 hours to review and assess.

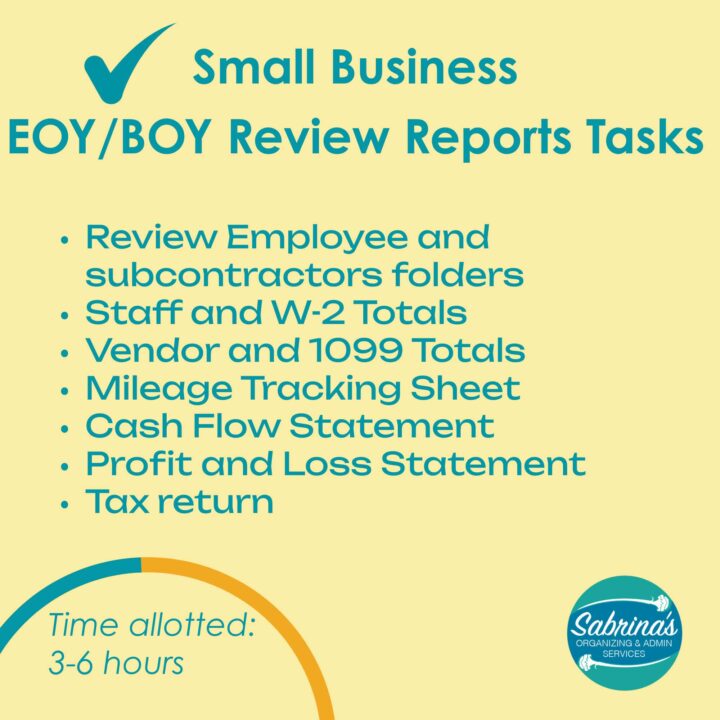

End of Year/Beginning of Year

At the end of the year or the beginning of the following year is a perfect time to assess how your goals have progressed and whether you have achieved them. Below are the Review Business Bookkeeping reports to visit at the end of the year or the beginning of the following year.

Review Employee and subcontractor folders – Before the end of the year, you will need to visit your employees’ and subcontractors’ files. Checking that you have a W-9 form and other information in their files. Confirm with the employees that they do not wish to change their withholdings and that no changes have occurred, such as a change in their address, name, or marital status.

Staff and W-2 Totals – Gather this information to complete your W-2s and W-3 forms for printing/electronic submission, which will be submitted to the IRS and provided to employees. Be sure to verify that the information matches your Payroll Summary Yearly Report.

Vendor and 1099 Totals – Ensure that the tax summary report you print out each year, which includes all your business deductions, accurately reflects all the transactions you conducted and categorizes them correctly. Visit my Create a 1099 Checklist sheet to create a tracking sheet for all your 1099s subcontractors.

***2026 YEAR***Increased reporting thresholds: From the One Big Beautiful Bill Act: the new For Forms 1099-MISC and 1099-NEC: The threshold for reporting payments on these forms will increase from $600 to $2,000 for the 2026 tax year. This threshold will be adjusted for inflation in subsequent years, starting in 2027. – This does not apply for 2025.

Other reports to visit

Mileage Tracking Sheet – Throughout the year, you should track your mileage and activities to have supporting documentation when deducting your mileage for business purposes.

Cash Flow Statement – Review this report to assess and determine goals by examining the money coming in and the expenses going out over a specific period.

Profit and Loss Statement – Small business owners need to review end-of-year reports to view overall growth and loss, as well as any anomalies or issues that occurred during the year. You can easily assess your profit margins using this report. You can also determine your net profit on this report.

Tax return – visit last year’s tax return details after your return is finished. This will provide you with a clear understanding of exactly what was deductible during this period of time.

Note: just because you may have an accountant or Bookkeeper doesn’t mean you don’t have to look at these reports. They are not responsible for your small business or your business decisions, nor the long-term success of your business’s financial health, so make sure you know exactly what can be deducted and what can not.

How much time does reviewing this section take?

This task should take approximately 3-6 hours to complete, as you will conduct a thorough review of your data and ensure that all reports are up to date and accurate.

Other factors to keep in mind when determining the accounting reports to review.

Businesses and industries are different. While some of the above financial reporting are the same for all businesses, there may be additional ones you will need to look at for your specific type of business. Below are further points to consider.

- Smaller businesses may need less frequent reporting than larger businesses.

- Businesses with products will need to add additional tasks throughout the year, like quarterly inventory checks.

- The indicators for companies with products may differ from those with service-based businesses.

- Check with your accountant and bookkeeper if you are unsure about the categories to use and whether you should provide more specific details for them.

- To save time, you can save the reports for future reference.

- Whether you use QuickBooks or other software, ensure consistency in your data to accurately compare transactions to prior periods.

I hope this post helps you and your business achieve your goals and saves you money. If you’re looking for help setting up an effective bookkeeping binder or establishing the best Chart of Accounts for your specific business, feel free to reach out so we can work together on this task.

Visit my Small business financial posts and my home office deduction posts for ideas.

[…] How Often to Review Business Bookkeeping Reports […]