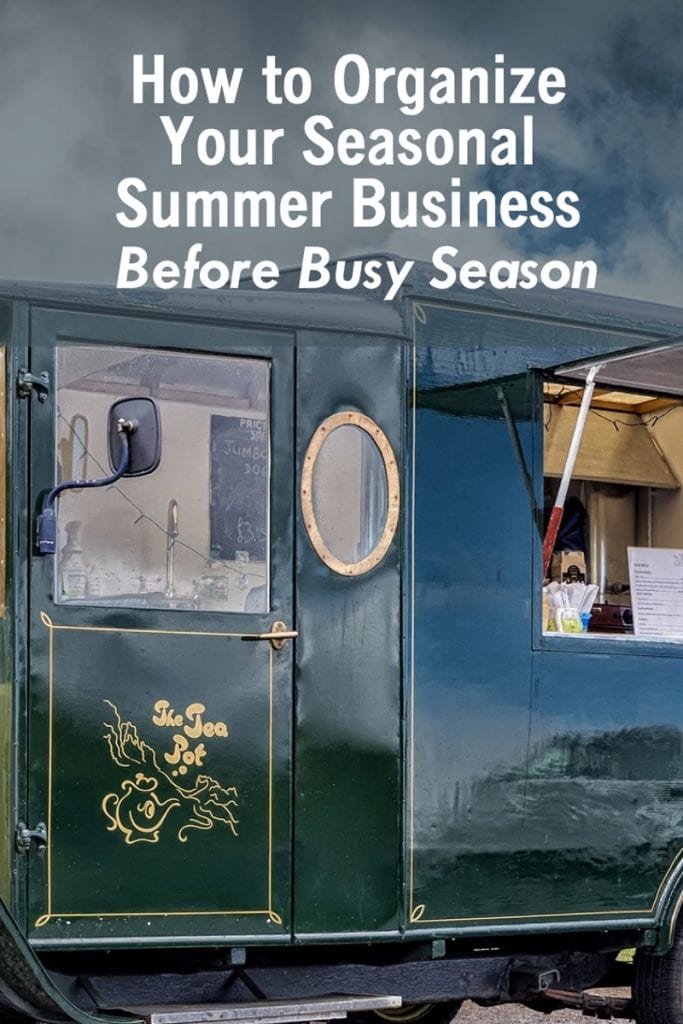

Some years ago, I worked with a food truck business owner who would have super busy summers, and we found that it was tough for them to stay organized when they were going from event to event all in one weekend. So, to help them, we implemented several processes. Below, I am sharing how to stay organized with a seasonal summer business.

5 Tips To Organize Your Seasonal Summer Business

Create a list of events needed for the entire season.

For a Seasonal Summer Business, this time of year is the best time to schedule those upcoming events. Keep a list of the yearly events you participate in and when the coordinators request vendors. Use an online calendar to manage all the activities. Write the details of the events in the appointment memo section and send the appointment to anyone who needs to attend the event. Have it sync to your phone, so you have it with you. Keeping your schedule and sharing it with staff early enough will eliminate the last-minute schedule issues that may occur.

Have a place for your receipts in your office.

If you have a food service business, you must keep your receipts for 2-3 months after serving the food just in case something happens. Scanning the receipts is OK. You can use a self-scanner (affiliate). But, if you can get an organized accordion folder and label it by month or category (like food and other expenses), you should manage the receipts well.

Have a place for food receipts for on the go.

This could be an envelope (affiliate) with the word “receipts” on it or an accordion folder with the categories so you can sort the receipts right there when you get them. Either way, this will help you transport the receipts from your vehicle to your home or bookkeeper. Organize the receipts into categories like food, office supplies, misc expenses, etc.

Track your employee hours (cash and payroll).

If you pay your Seasonal Summer Business staff with cash or use a payroll service, you must track your employee hours on a spreadsheet or software like QuickBooks. Write the date you paid them, the name of the employee, and the amount you paid if you choose to create a spreadsheet. Also, be sure to separate the tips for tracking purposes. You don’t need to track them for them, but you should separate them out, so the staff knows how much was from tips.

Track your sales tax (cash and credit).

If you use cash for your business, you must track your sales to pay your sales tax if your state has one. Check your state to see if you need to collect sales tax. If so, you will need to have a way to track this. Use a spreadsheet to record the number of your sales and then use a formula like this to calculate automatically how much sales tax you collected.

Formula = name of the Cell in the spreadsheet, ie. E12 X (multiply by) the percentage of sales tax

This way, at the end of every week, you can then transfer that amount to the savings account for taxes later on. Keeping your tax collection money separated is important. Remember, it is not your money; you are collecting it for the state or local city. In Pennsylvania, sales taxes must be paid out quarterly or twice a year, depending on how much you collect for small businesses.

I hope this helps you organize your small seasonal business for the season. I hope you have a great season. If you need help, please be sure to contact a professional bookkeeper or accountant to guide you through this process. Paper management can be overwhelming, but taking these simple steps and establishing a system before the season starts will help you and your bookkeeper stay on top of everything.

Below are some additional tips to help you with your summer seasonal business.

10 tips for seasonal survival of your small business

If you need help organizing your seasonal business, check out our Procedure Evaluations and Refinement Services.

Please note that these are affiliate links through Amazon (affiliate). At no additional cost to you, I will earn affiliate fees if you decide to make a purchase.

Related Posts: