Some small businesses write a check made out to cash. This is where you write the word CASH in the payee area and write the amount out. Anyone can cash the check. While it is convenient for owners to do this, it is best if they don’t. Anyone can also deposit it; if you lose it, anyone can deposit it. This practice is not recommended because it is hard to keep track of the expenses used for this cashed check, among other reasons. However, if you need to do this, today we are discussing how to keep the costs from the cash payee check in order just in case you get audited.

Table of contents

- Below are steps to record checks made out to cash to protect your business:

- Place Cash in an envelope

- Add all the cash slips (Amazon affiliate) , gas slips, and invoices the check will associate with together in the envelope.

- Create a Spreadsheet on your computer or online

- When you have used up all the cash, create a current year file in your office filing cabinet.

- Visit these posts to get more information about cash transactions.

You need to keep really good records since the IRS looks for the backup paperwork for these cash withdrawals when they do their audits. Keep in mind that we all need cash for various purchases. If we work with cash often, these steps will help you stay organized with your bookkeeping.

Below are steps to record checks made out to cash to protect your business:

Place Cash in an envelope

After getting cash, place the money in an envelope (affiliate). Write the day you withdrew the money so it will match up with your bank register. Do not reuse the envelope (affiliate) for anything other than this cashed check.

Add all the cash slips (Amazon (affiliate) affiliate) , gas slips, and invoices the check will associate with together in the envelope (affiliate).

, gas slips, and invoices the check will associate with together in the envelope (affiliate).

Get all the receipts that pertain to cash. There is no question about it. You NEED THE RECEIPTS!

Create a Spreadsheet on your computer or online

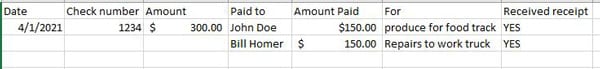

Create a spreadsheet that includes the check number, date, amount, and all the associated payments for the cashed check. Print out the spreadsheet, and staple the receipts to it. Below is an example of how a spreadsheet of expenses would look for cashed checks.

When you have used up all the cash, create a current year file in your office filing cabinet.

Name the file, the check number, and the date you wrote the cash check. Add all the receipts and the envelope to the folder. If you do this often, you may want to get an accordion folder for receipts to help you organize the receipts with the cashed checks. Below, you will find some accordion folders (affiliate) for receipts I found on Amazon (affiliate)(affiliate).

Buy Now →

Buy Now →

Accordion File Folder Small Holder File 13 pockets

Buy Now →(affiliate)

If you decide to do the accordion folder option, you can label each tab the date and check number and place the receipts inside.

Doing these steps will help you have the correct backup records for an audit. Keeping these cash checks clear for your business will eliminate any headaches you may have at the end of the year.

Another option is to make the check out to yourself and deposit it in your personal account. Keep the receipts in an envelope marked with the check number and date cashed so you or your bookkeeper can add them to your Quicken (affiliate) or QuickBooks account. Receipts are super important and should be organized well to help you and your accountant.

Visit these posts to get more information about cash transactions.

8 common tax audit triggers to avoid

How to Bring More Cash Into Your Business Right Now

If you are wondering how long you should keep documents for your small business, including these cash transactions, check out our post: How Long Should I Keep Business Records

Please note these are affiliate links through Amazon (affiliate), and at no additional cost to you, I will earn affiliate fees if you decide to make a purchase.

Visit our other Related Articles!