All small business books must be well organized. This statement is especially true for Real Estate agents. Since they are usually smaller entrepreneurs, they must be vigilant about how they keep their bookkeeping. This post discusses real estate bookkeeping tips to help you stay organized and productive. Follow along and take action today to get organized with your bookkeeping.

Topics

First, let’s start with where you place your papers.

Keep papers separate.

When solopreneurs work out of their homes, they may blend their papers with their business ones. Doing this will create headaches later when filing taxes. Make it a point to have one filing cabinet (affiliate) or area that is strictly for your small business. It can either be a specific filing cabinet (affiliate) or just a drawer. Below are some filing cabinets I found on Amazon (affiliate) (affiliate).

Lateral File Cabinet with Lock by INTERGREAT

Buy Now →(affiliate)

Additional real estate bookkeeping tips involve keeping support paperwork for the business organized.

Have a well-organized business binder.

A well-organized business binder lets real estate agents have all their papers in one place and helps them find something in a pinch. So, start by creating a binder to hold your monthly papers. Over the years, you can grab and review information quickly. Things to include in the binder would be:

Bank statements from all the business accounts. Place the personal accounts in another area.

Credit card business statements should be together. If possible, staple the receipts for each statement on the back of each statement each month. Then, file away together.

P&L reports / Balance sheets—Printing these out gives you a snapshot and may be helpful for you to remind yourself without having to go into the software or app and regenerate a report.

Completed Tax Returns – When you receive your finalized tax return from your account, keep a copy and place it in the binder in a pocket. This will allow for easy access if there are any questions after you file.

Unique situations and correspondences that happened that particular year. An example would be notices that you got from your tax agencies.

Bills that are usually used for the business or your business office. They could include utilities, mortgage paperwork, legal fees, accountant fees, repairs, insurance, cleaning, and maintenance services receipts.

If you find that paper can get out of hand and you want to go paperless, you can do that instead. Keep all the folders in the main folder called “20__ year business tax paperwork”. Each year, create a new one that holds all the scanned and PDF documents you made for the year. This tip will help your accountant see support documents if there are any questions when doing your tax return.

Create a system for your receipts.

Using accordion folders (affiliate) with covers helps keep business receipts in order. If you have many smaller receipts, you can use a 13-tab accordion coupon-size folder. See the images below.

Accordion File Folder Small Holder File 13 pockets

Buy Now →(affiliate)

If you have many 8 1/2 x 11 sheets of receipts, you can use a filing cabinet (affiliate) area organized by file folder account names that work for you and your accountant. On the other hand, if you have a few paper letter-size receipts, you can quickly get an accordion folder that is letter-sized like these from Amazon (affiliate) (affiliate).

Buy Now →

Buy Now → (affiliate)

If you want to go digital with your support documents, that works, too! Have a separate area under the main year folder. Be sure to keep a legible copy of the receipts, especially if you are doing meals, entertainment, and travel. Write what you did at that meeting in detail on the receipt so you remember if you have to look at the meal or travel receipt again.

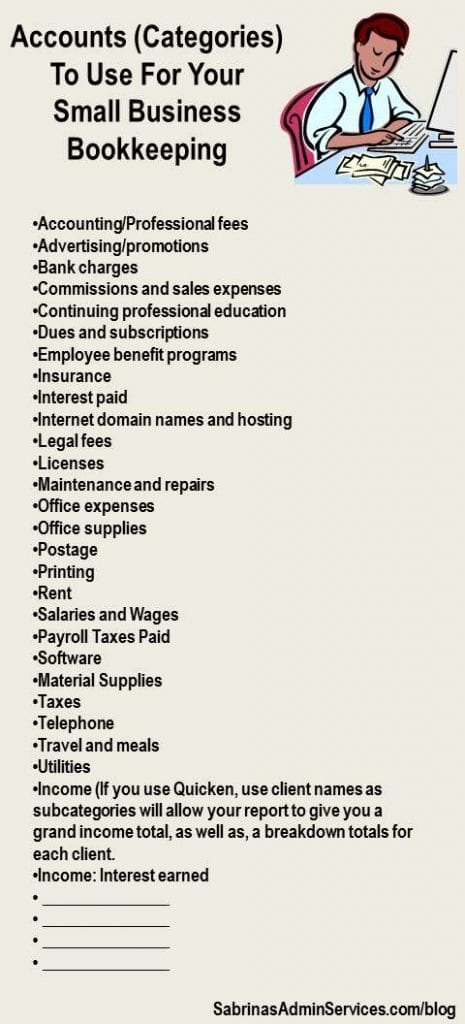

Use an online service or software on your computer to track all transactions.

Using applications like QuickBooks Online, Wave, or FreshBooks (affiliate), you can easily set up your account and organize it from the get-go. Each dollar must have an account (or category) attached to it. Adding them to the register will not constitute a well-organized P&L Report or Balance Sheet. Lucky for you, they usually add a handful of categories (accounts) to help you get started. Feel free to check out our list of categories (chart of accounts) to start your business bookkeeping process. Below are just some accounts you can use.

Now that you have all your bookkeeping paperwork in order, keep in mind that you do not need to keep everything forever. Visit our How Long Should I Keep Business Records for tips.

If you feel you can not be this detailed, you can always hire a bookkeeper (like me). Some bookkeepers work at your office, others work remotely, but all will help you stay on top of everything. Some may even specialize in real estate bookkeeping tips. Please do not be hard on yourself; we all have our areas of expertise. It’s OK if bookkeeping is not one of yours.

Visit our Bookkeeping Services to help you and your small business!