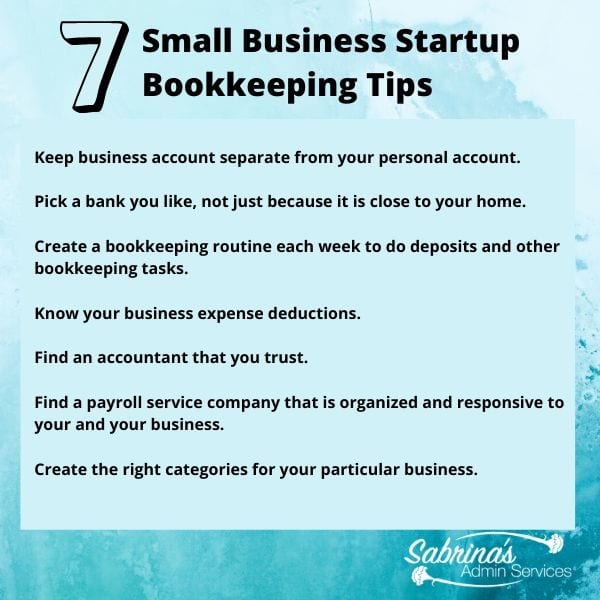

When starting a small business, numerous details need to be addressed. Bookkeeping is an essential part of daily small business tasks. I know it’s not glamorous. It’s not even fun to do. However, to save you money and stress during tax time, getting your small business bookkeeping in order will significantly reduce both. Below, we are sharing seven startup bookkeeping tips every owner should know right from the beginning. Follow along and take notes.

Startup Tips

- Keep your business account separate from your personal account.

- Pick a bank you like, not just because it is close to your home.

- Establish a weekly bookkeeping routine to handle deposits and other essential tasks.

- Know your business expense deductions.

- Find an accountant that you trust.

- Find an organized payroll service company.

- Create the right categories for your particular business.

Keep your business account separate from your personal account.

By doing this, from the beginning, you will have all your transactions separate from any business accounts. If you haven’t done this yet and started your business already, create separate account names or categories under the parent account name like, “Business” in your accounting software. Then, create additional subcategories/subaccounts under the main account name.

Pick a bank you like, not just because it is close to your home.

Just because it is close to your home or office doesn’t mean you need to use it. Inquire about their business services and determine if what they offer aligns with your needs. If you have a personal account at the bank, ask them about setting up a business account and how online mobile banking works with your personal login credentials.

Establish a weekly bookkeeping routine to handle deposits and other essential tasks.

Keeping your online bank register and accounts updated regularly will enable you to track where your money is going. Skipping a week may be an issue, especially if you have several transactions throughout the month.

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

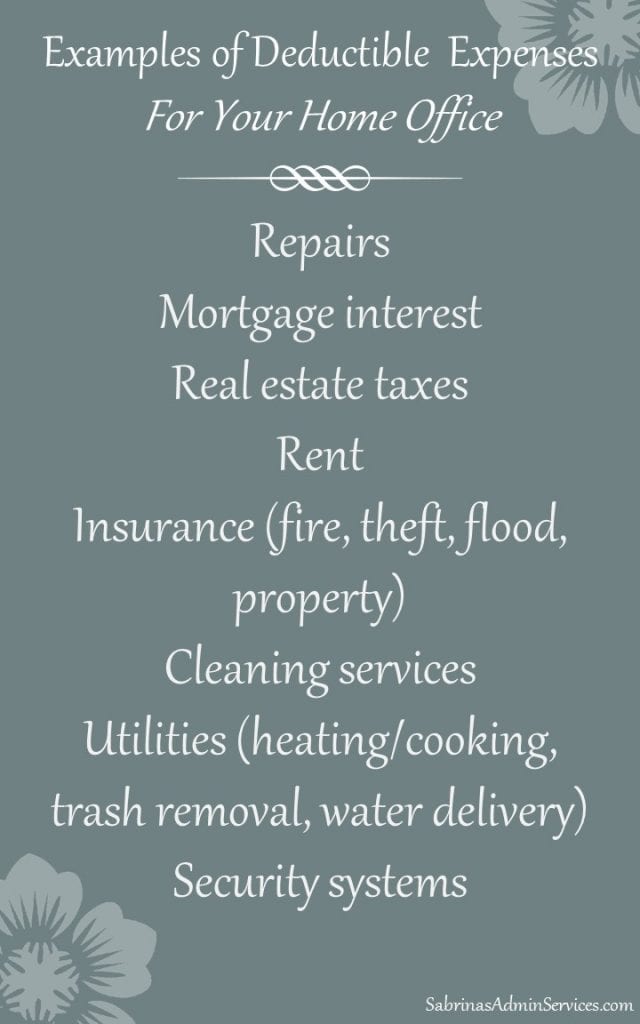

Know your business expense deductions.

Below is a list of home office deductions that will help you. Read more for details and learn how to make a tax return deduction organizer.

Visit the IRS’s website about Deducting Business Expenses for other deductions details about U.S. Business deductions.

Find an accountant that you trust.

Visit this article I found on the New York Times online: How to Find the Best C.P.A. or Tax Accountant Near You

Find an organized payroll service company.

Find a payroll service company that is organized and responsive to you and your business. Visit our post about how to pick a payroll service for more details. Remember, you are the only one responsible for your company, so knowing the way your payroll company is filing your company’s information is important.

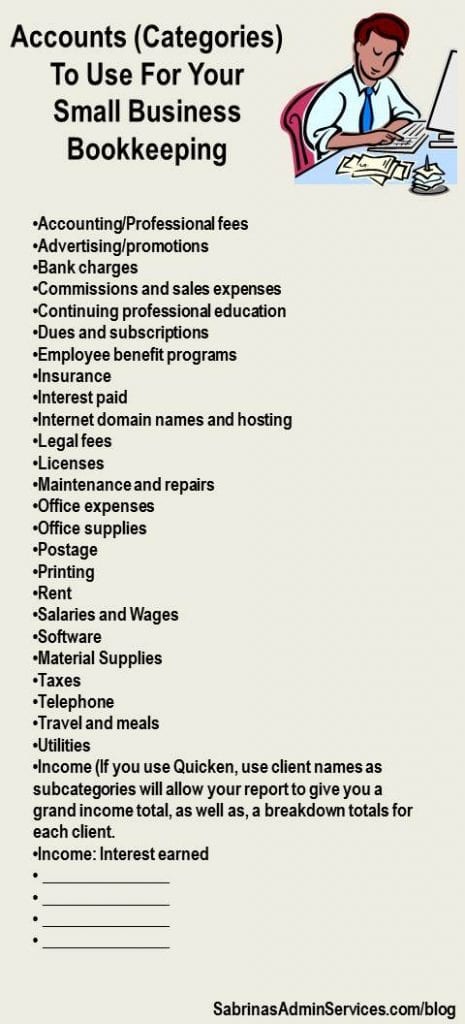

Create the right categories for your particular business.

Feel free to visit the basic list of accounts (categories) you can use in your bookkeeping management app or spreadsheet by clicking on the image below.

Visit our post for the details of all these accounts (categories): How To Make Your Business Budget More Effective

Feel free to share this image with your other small business startups!

I hope these startup bookkeeping tips help you get your business organized and ready to serve the public.

Related Posts:

If you want more additional information and tips, feel free to visit these posts I found online below.

12 Small Business Bookkeeping Tips

Top 25 Bookkeeping Tips From the Pros

Do you have any startup bookkeeping tips you want to share? Feel free to add them to the comments section below. We would love to hear from you.