It’s no secret that disasters happen even in business. But are you ready for it? How much money do you need in your small business emergency savings (Rainy day fund) to help you in the case of those moments? This question is the question we are going to tackle today.

Table of contents

- How to analyze a year-end P & L Report?

- Now, let’s find where we can save the money for your small business emergency savings.

- Now that you found some money to save for a rainy day fund, where will you put it?

- How to save money without doing too much leg work?

- How much to save?

- What is a small business emergency?

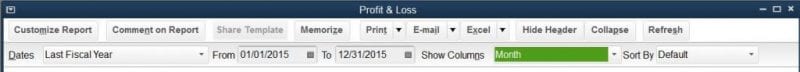

First, we need to determine what your current monthly expense is in your small business. If you use bookkeeping software, this will be pretty easy to do. Print out last year’s Profit and Loss report (P&L) and categorize it by month.

As you can see in the image above, I changed the date to Last fiscal year, the date range automatically varies. Then, you need to select Show Columns: Month. This task will show you each month’s breakdown.

How to analyze a year-end P & L Report?

In your report, analyze things like payroll, fringe benefits, taxes paid, the monthly cost of goods sold, and general office expenses like office rent, car insurance, liability insurance, etc…

NOTE: if you are using a credit card that isn’t a part of your QuickBooks Pro, go to the website and analyze your data in the report from your credit card company. They usually give you a business report at the end of the year to help with taxes. This report is a great asset because it will provide you with totals and when it is charged.

After getting this information from all your reports, add them up on a SEPARATE spreadsheet. If you don’t want to recreate the report, QuickBooks Pro allows you to export this P&L report into Microsoft Excel. You will then be able to add the expenses to the report and modify the labels and headers already there. In Excel, inserting rows works great to add information to this report. Ensure you add the amount to the bottom totals for each month.

The content you love. The privacy you need.

Keep your online activity safer and more private. Annual plans come with a 60-day money-back guarantee.

Now, let’s find where we can save the money for your small business emergency savings.

After you got all this information and looked at all your fixed expenses (rent, insurance, etc…) and all your variable expenses (payroll, cost of goods, telephone, the internet, etc…), now it is time to really figure out where you can cut your expenses to be able to save. I like to look at the following areas on the P&L to do this:

- Insurance (car insurance) – car insurance can be revisited each year to see if you can save. I have, in the past, contacted my agent, and they reassessed the policy, and it turns out we saved an additional 50 dollars each month. Wow. I should have done it sooner.

- Internet – If you went with another provider, would you get more money back?

- Cellphone or Telephone – Should you change mobile phone plans? Do you need a landline anymore?

- The Cost of Goods Sold Products you use. Is there another product you can use instead that is more affordable? Note: this may compromise your quality of service, so do with caution.

- Office supplies – Maybe you can get those reams of paper you buy each month cheaper.

- Monthly service costs – do you need the service agreement monthly fee for your new computer?

To find the money to save in your P&L, ask yourself questions like:

- How often do I use this service?

- Does this add to my business quality?

- Does this add to my business’s reputation?

- Is there something else I can do to improve my product or service without sacrificing my reputation?

Now that you found some money to save for a rainy day fund, where will you put it?

Some companies make a mistake and put the money in the stock market. I recommend saving your money in a more liquid account. This means an account you can use immediately or within a day or two max. Creating a money market account in your bank is the best bet. Sure, you are not going to get a significant return these days. But, the advantage of having access to the money for a rainy day is a priority. You are not here to make a massive return on the capital; you are here to use it but only for emergencies.

Caution: Make sure your bank is insured to protect your money if they have an issue.

How to save money without doing too much leg work?

Many banks offer a way to create an auto transfer to the money market account. Ask your particular bank for details. This way, you know how much gets transferred each month. I like using the minimum amount and then manually moving the excess profit (if any). This helps keep the expenses under control.

How much to save?

That is really up to you. Each company is different. Some companies save thousands each month, and others save one hundred dollars. The trick is to save extra for those months where you have a more substantial profit so on those other slower months, you will feel more at ease if an emergency arises.

Whatever you decide on, you can start small and increase it over time. Opening a separate bank account and setting up auto withdrawals will increase your savings much faster.

What is a small business emergency?

Now that you saved all this money, when can you spend it? I recommend making a list of the possible emergency scenarios, like food costs increasing in the winter, subcontractor costs being high due to more work in the summer, etc… It could also be like what we are going through right now. It is a fallback for you and your business in case you need it. Creating small business savings will give you the peace of mind you want in that uncertain time.

I hope this post inspires you to create a small business emergency savings fund. And I hope you don’t have to use it. Happy saving!

Now, it’s your turn. What areas do you examine when you need to save money? Please leave a comment below. I look forward to hearing from you.

If you need help figuring out how to save money over time for your small business, please contact us for a consultation.

Please note these are affiliate links through Amazon (affiliate), and at no additional cost to you, I will earn affiliate fees if you decide to make a purchase.

Related topic:

My bookkeeper suggested looking at the amount of tax we pay per year, dividing it by twelve, and transferring it to a savings account once a month. That way we’re never caught unprepared come tax time! Sometimes it works out that we don’t need to touch it, or only use some of it, but that’s a lot better than paying late fees!

Great suggestion, Janet. Thanks for commenting. =)

Sabrina – regarding the cost of goods: if only we would REALLY look at these things! I work at a small rural hospital. At work, a friend of mine recently compared prices of the sterile coverings that go over very small surgical tables (approx. 2 ft x 3 ft), which we use for cataract surgeries. Our surgical department uses about 30 of these every month. When my friend finished comparison shopping, she was able to save the hospital about 20K per year!

Hi Sabrina,

Great tips for making sure we have a small emergency fund saved just in case with need it! Thanks for sharing!!

I do my best to stay on top of these areas and have found many ways to upgrade my processes this past year and have gained a great deal. Now that feels good! I am always interested to learn more and appreciate these valuable suggestions.

It’s always a good idea to periodically check the business for possible money leaks.

I’ve been guilty of signing up for a monthly service and then not using it. Laid out quite a bit on that on, until I had the courage to admit I wasn’t ready to take advantage of the service. Took the monthly payment and redirected it back into savings as a means to make me feel better. I’m now much more cautious about what I sign up for.

This is a really good group of suggestions for a subject that most of us ignore. You give such practical solutions and present them in little steps that make them seem less daunting. Great idea to check your existing suppliers and see if there is a less expensive option.

Brilliant article! I think you need to look at every aspect of your life and business and revisit. I have killed subscriptions that I no longer used, or used infrequently. I just got new car insurance; BTW, many companies will suck you in on a deeply discounted new policy just to get your business and then jack up the rate at renewal. If that happens (and it did to me), start shopping. One of the silly things I do is recycle my print jobs; just turn over those pages and use them to check out my drafts. I feel so…green! 😉

It’s amazing how much you can save by regularly checking service provider (such as insurance) costs and comparing to see if you can get a better deal by moving or negotiating with the current provider. Having a rainy day fund makes good money sense.

This is a great list of tips as always, Sabrina. I am constantly reassessing where I can save money and how I can eliminate costs that aren’t necessary. Since I work from home, somehow my business and my home expenses often overlap and it might be wise to delineate them more to have a clearer picture.

At first, I thought, this doesn’t apply to my small business &then realized I am just now looking at eliminating a monthly expense. My plan was not to use it for emergency fund but to apply it to more platform advertising. We are conducting a test to determine the ROI & then will decide.

Sabrina, I SO need to do this–especially the analyzing my P&L and changing things. I’ve known for a long time I needed to consolidate internet, phone, etc., and have been just too busy to sit down with that. I know, insane. I’m leaving money all over the place.

Thank you–you just kicked my butt into gear again 🙂

I’ll be honest: this is a topic that we haven’t discussed too often. I love the suggestion to automatically move the money, which makes the process much less time-consuming. This is a terrific topic for business owners. You can never be too prepared for an emergency.