As a startup solopreneur, many tasks must be completed in a new small business. Many to-dos are bookkeeping-related, and not everyone enjoys doing bookkeeping tasks. However, if you don’t establish a proper system now, you will likely regret it later. Fortunately, I’ve compiled a list of ways to streamline your bookkeeping tasks. Do only a few at a time to help you speed up the process.

Tips

- Make a list of all the bills you can schedule to pay automatically

- Write checks through your business bank account’s Bill Pay.

- Use QuickBooks or Quicken to download transactions automatically on a regular basis.

- Ensure the bank offers a way to download files in QuickBooks or Quicken.

- Have a bin just for paper bills that come in.

- My favorite bins for “To Be Paid” and “To File” bills

- Set up online access to all your bills’ sites.

- Revert to e-bills.

- Schedule all autopay payments at the end of the month.

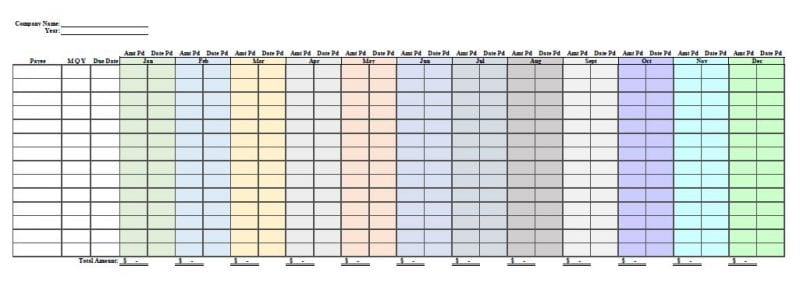

Make a list of all the bills you can schedule to pay automatically

Gather this information over a quarter. And write it on a Bill Pay Sheet. See an example in this post: How to Create a Solopreneur Business Tracking Expenses Sheet

Write checks through your business bank account’s Bill Pay.

The handwritten checks are the same as those you create and your bank sends through its Bill Pay service. The only difference is that the check number is longer. Tip: Be sure to write the check number in your bank register to keep track of all check numbers, in case someone asks you if you’ve paid a bill.

Be sure to save all the information, payee, address, and phone number in bill pay to make sure you have it for next time. Also, include the payment details in the memo section and the notes section for quick reference.

Use QuickBooks or Quicken to download transactions automatically on a regular basis.

The software usually memorizes the categories for a particular payee, so you don’t have to remember what category (account) to use. Here is instruction on how to create, edit, or delete memorized transactions for QuickBooks Online. Below are the steps to develop memorized payees in Quicken. Additionally, when you need to reconcile in Quicken (affiliate), it recalls all the cleared transactions downloaded from the bank, which makes reconciling extremely quick – typically within 15 minutes.

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

Ensure the bank offers a way to download files in QuickBooks or Quicken.

Some banks do not provide downloads into older versions of QuickBooks or Quicken (affiliate). However, if you have QuickBooks Online, they do offer a way to download transactions even if your bank doesn’t support the QuickBooks format. Here is a post I wrote earlier about the Pros and Cons of using QuickBooks Online.

Have a bin just for paper bills that come in.

Place this where you sort your paper mail. You may not have many of them, but if this bin isn’t needed, you can use a bin for “to do” papers instead. For clients (affiliate) who prefer paper and have a visual of what they need to do, we found it beneficial to have a “bills-to-pay” bin and a “paid bills-to-file” bin. You can also use the additional cubbies as an in-bin for papers you need to read. Below are a couple of options for you.

My favorite bins for “To Be Paid” and “To File” bills

Cubbies: In-Bin Wooden Desktop letter Tray File 3 layer

Buy Now → Buy Now →

Buy Now → (affiliate)

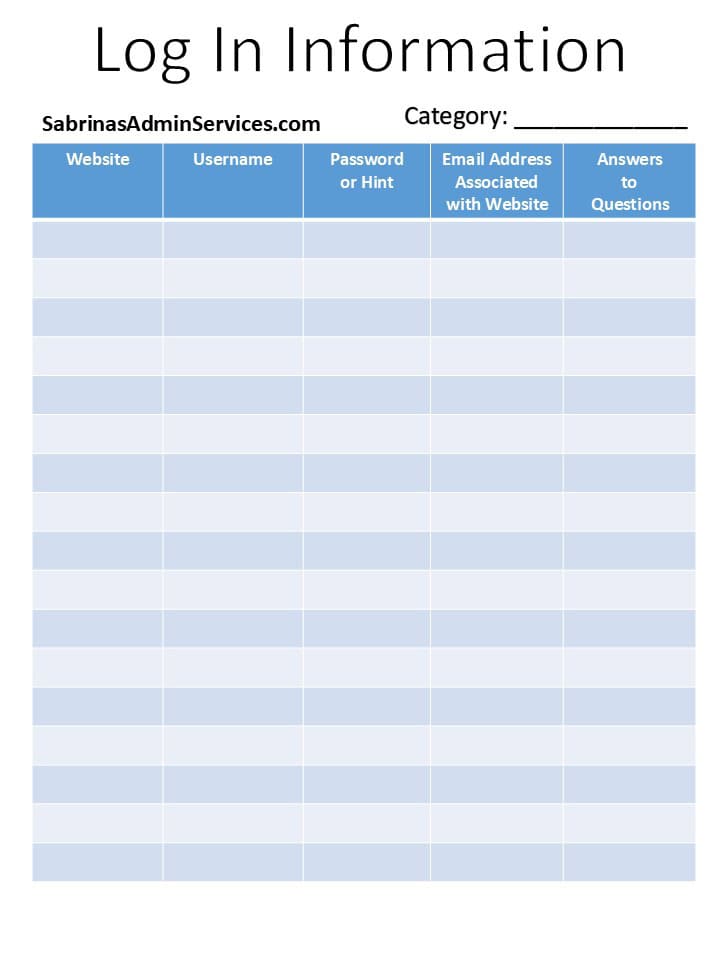

Set up online access to all your bills’ sites.

Doing this over a few months, as bills come in, will really help you stay on top of everything on the go. Create a login list to help you track your login information, specifically for bills, using LastPass or a paper format. Here is a post from my organizing site that includes a log in the sheet(example) you can print out. Use an app like LastPass or another password management tool to access your passwords from anywhere. You can also easily share passwords and other private documents with close family members.

Revert to e-bills.

No more paper bills. Have them email you when the bill is ready. Tip: On your iPhone, create these bill senders’ names as VIP items on your phone. Here are instructions on how to do it. The iPhone will mark your emails as VIP when they come in and will stand out from all your other emails. You can also create a folder called “To Pay” and check it once a week to review the bills.

Schedule all autopay payments at the end of the month.

Contact your credit card provider and request that they update the payment due date to the end of the month. Then, you can set up an autopay for that time, knowing that you will have the funds you need to pay the bill by the end of the month.

By taking the time to set this up now and establishing a system, you will save time in the future. So, yes, it will take you time to set this up, but it will make your work life easier later.

What are your tips to speed up your bookkeeping tasks? Please leave a message below. If you need help with your small business bookkeeping tasks, please check out our services here.

Please note that the link above is an affiliate link through Amazon (affiliate). At no additional cost to you, I will receive affiliate fees if you click through and make a purchase.

Related Posts: