Whether you are an independent contractor or are a small business owner, to stay on top of your business throughout the year, doing tasks quarterly will make your end-of-year much easier and income taxes much less stress-free. So, to do that, I recommend making a Quarterly Small Business Financial Checklist. Since quarters 1, 2, and 3 are pretty much the same, you can create one checklist for all these quarters. Today, I will share the areas to add to this quarterly checklist. This involved primarily financial tasks that need to be done to make sure your business is running smoothly throughout the year.

Checklists to Make

Keep in mind that this post will discuss eight different task groups. However, you may not use all of them, and there may be other groups for your particular industry/state/country. Please add or remove the tasks that do not apply to you and your business. Let’s begin.

Note: This checklist is NOT to be used for Quarter 4 because there are additional tasks to complete beyond those listed here. The Quarter 4 checklist should include end-of-year and new-year tasks, such as IRS forms W-2 and 1099s.

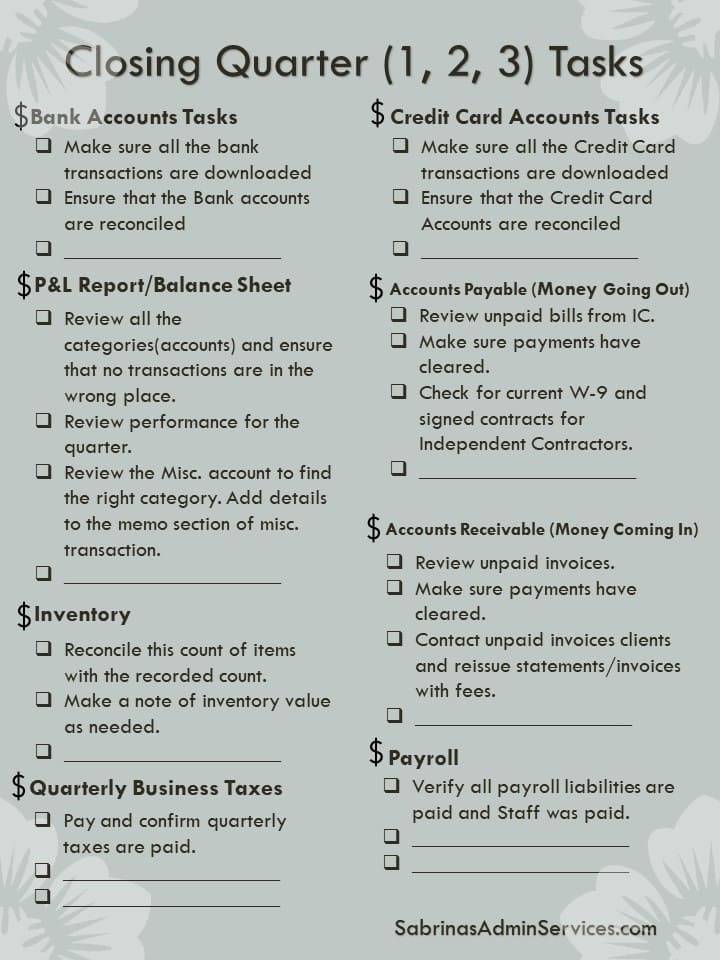

Bank Accounts Tasks

First, let’s discuss bank account tasks. Your business probably has a checking and a savings account. Both of these accounts should be reconciled. Keeping them reconciled with your bank will help keep you on top of fraudulent transactions and account issues. These bank statement reconciliations should be completed at the beginning of every month, but if your business is small, you could do them quarterly.

First, make sure all the transactions are downloaded from your bank into your money management software, like FreshBooks(affiliate), QuickBooks, or Quicken (affiliate). Using the date range, be sure to select the right range for that particular quarter.

- Quarter 1 is from January 1 to March 31st.

- Quarter 2 is from April 1 to June 30th.

- Quarter 3 is from July 1 to September 30th.

Credit Card Account Tasks

The next section of tasks is to download your credit card transactions and reconcile your account. Some credit cards may create errors when downloading, so take your time through this process. If you feel you can’t trust your downloads, try manually entering the data and then downloading and linking the right transactions with your existing register entries. You can spot duplicate transactions this way.

Again, to quickly identify and eliminate fraudulent transactions, it’s best to reconcile every month instead of waiting for each quarter. The longer you wait, the more likely you are to forget transaction details. No one can remember everything in their small business.

Manage your financial life and achieve more. Try Quicken for 30 days with our money-back guarantee. Products To Help You Manage Your Money:

Quicken Simplifi - Great for personal tracking

Quicken Business & Personal - perfect for mobile users strictly

Classic Quicken for Windows and Mac - Ideal for laptop users and convenient for viewing on the go.

Profit and Loss Report/Balance Sheet

The P&L statement, also known as the Profit and loss report, shows the Income and Expenses from your business over a given period of time. For this purpose, you will look at these reports over a three-month period and compare them to the prior three-month period or prior year.

The Balance Sheet is usually for your accountant. It is a statement of a business’s assets, liabilities, and owner’s equity as of any given date. Typically, a balance sheet is prepared at the end of set periods (e.g., every quarter or annually). It is good to view this statement (definition from Small Business Administration); however, you probably will not do anything with it. If you do have questions, you can ask your accountant for help.

Each bookkeeping software is a little different on where they place these reports. Usually, these reports can be found in the Reports section of the main menu.

Other reports, like a Cash Flow Statement and Cost of Goods Sold Report, may be needed depending on your industry. If you have other reports you would like to examine, you can add them to this section.

Is it mid-year? Ready to do your Small Business Mid-Year Review? Check out this post for help with Small Business Bookkeeping Mid Year Review Tips.

Quarterly Business Taxes Tasks

The next section that should be added to your Quarterly Small Business Financial Checklist is quarterly business taxes. Whether you are a sole proprietor or have a business, you may want/need to pay quarterly estimated taxes. Having a section on your checklist that details the type of estimate tax payment (Federal, State, or Local) and how to submit or mail the payment works nicely. You can also add the amount if it is a fixed number and login information to make it easy to do when you need to pay them.

Below are some information you may want to add to this section:

- Federal: The date submitted or mailed, the amount owed, the login information, and the notes needed to make this transaction.

- State: Date submitted or mailed, the amount owed, login information needed, etc.

- Local: Income amount for the quarter area, amount owed section for this quarter, and login information needed.

Accounts Payable (Money Going Out) Tasks

The next section (business expenses) should include anything that involves money going out. This can also include quarterly bills. These bills may be ones you forget because it does not happen monthly, like the sewer or water bill.

Another task you would need to do is to review unpaid bills from vendors, make sure all the unpaid bills from IC are paid, confirm that all the payments have cleared, and check the files (digital or physical) to ensure that you have the subcontractors’ current W-9 signed forms and contracts.

Also, you can file receipts in the appropriate area physically or digitally.

Want to learn more? Accounts Payable Tips Every Owner Needs to Know

Accounts Receivable (Money Coming In) Tasks

The next section of tasks is to the incoming money. In this section, you can add tasks like reviewing unpaid invoices and sending out newly updated invoices with late fees. You can also make sure all the payments are cleared through your bank statement.

Get more information at 9 Things Every Owner Needs To Know About Accounts Receivable.

Inventory Tasks (optional)

This checklist section is only done if you have inventory in your business. Products you use to make something else or products you sell to customers should be in this section of tasks. Having an inventory tasks list will help you determine your inventory status and what you need to order or not order anymore.

You can also visit the cost of the inventory items and see if other supplies are more affordable to buy those products. This will give you a better idea of how much the items you need cost and what items you spent too much on.

Payroll Tasks(optional)

Lastly, review your payroll tasks section. This involves ensuring all your payroll liabilities are paid, and your staff is paid. It could also include making the payments and sending in or submitting the quarterly returns electronically.

Please note: Each business has its own payroll tax requirement. Be sure you know your situation before making this checklist section.

You can also use this section to review employee paperwork and ensure you have all the documents for your employees. Visit my How to Organize Employee Records post for more details. Verify things like social security numbers for new employees.

Don’t want to make up one yourself? I have a white background version that you can get for free, plus all my other checklists for small businesses. Feel free to fill out this form and get not only this checklist but all my other small business checklists to help your business stay productive and on track!

Quarterly Small Business Financial Checklist (1,2,3 only)

Get your free copy of the Quarterly Small Business Financial Checklist to remind you what needs to be done each quarter.

Conclusion

Well, that’s it for now. I hope this post helps you organize your quarter tasks and make them easier to manage during tax season. Please leave a comment below with any questions.

If you are looking for more money management and productivity posts, check out the posts below.