This year, you have a new informational form to submit to the IRS at the end of the year. It’s called 1099-NEC. This new form is intended just for Nonemployee Compensation (NEC) vendors and is used by businesses to send to the IRS and the vendors. This week, I am going to share the high-level details to help you add this task to your to-do list.

***2026 YEAR Increased reporting thresholds:

From the One Big Beautiful Bill Act: the new For Forms 1099-MISC and 1099-NEC: The threshold for reporting payments on these forms will increase from $600 to $2,000 for the 2026 tax year. This threshold will be adjusted for inflation in subsequent years, starting in 2027. – This does not apply for 2025. ****

Topics

Who should get this?

- A nonemployee compensation that made at least $600 in the entire year.

- Services performed by someone who is not your employee (including parts and materials), Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish.

- Payments to an attorney who is not a corporation or an LLC.

How to use it?

It’s pretty straightforward forward, as you can see below.

Gather your totals together for each NEC and their essential information from your Vendor report after you reconcile your business accounts in January.

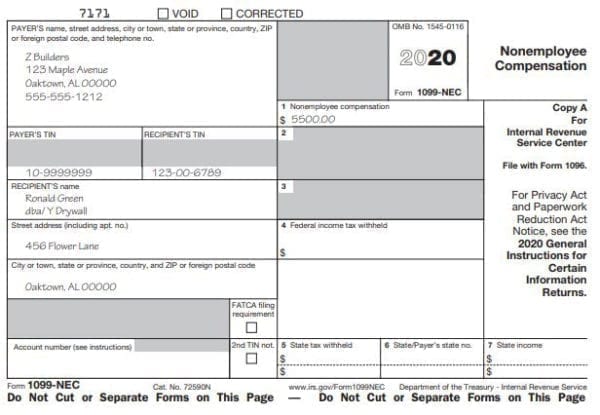

1099-NEC modified form:

For each nonemployee, add the totals from your vendor report to Box 1. Add all the payer’s information into the Payer’s section. Put in the Payer’s TIN and the Recipient’s TIN. Include the recipient’s legal name and address, city, state, and zip code. Add Federal income tax withheld in box 4. Then, in Box 5, add the state tax withheld. In Box 6, add the state number. In Box 7, add the state income. If you don’t withhold any taxes, disregard these boxes. That’s it.

Add additional information if needed in the other boxes provided. Visit the 2020 Instructions for Forms 1099-MISC and 1099-NEC PDF for more details.

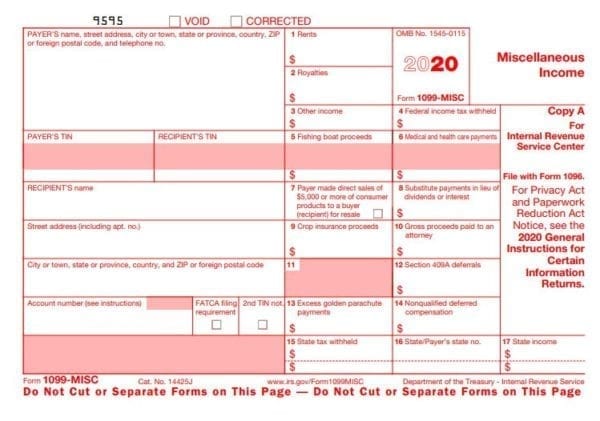

1099-MISC modified form:

Now, remember that this form was created for 2020; the 2020 1099-MISC has been adjusted as well. Below is what that looks like this year moving forward.

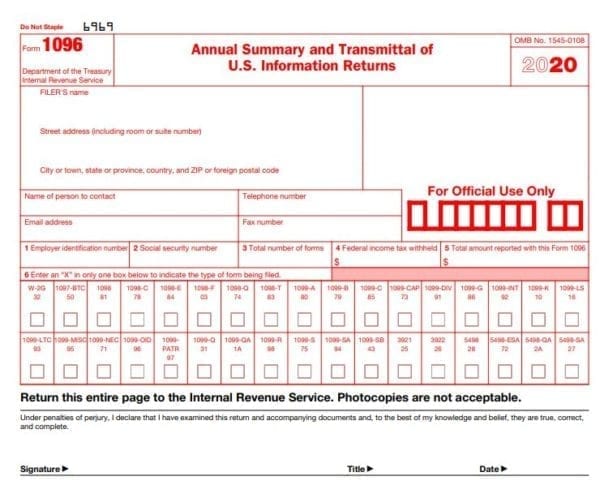

1096 modified form:

Be sure you include the totals for both 1099-MISC and 1099-NEC, plus any other informational forms you need to complete on the 1096 form. There is a checkbox for 1099-NEC. See the image below.

If the software you use to create and print the 1099s does not have the 1099-NEC form, you can order free forms from the IRS and type them up with a manual typewriter if you have one. Here is the link on where to order them: Online Ordering for Information Returns and Employer Returns Order them now and when they are ready, the IRS will send them to you free of charge.

I hope this helps you and your business be more prepared for the end of 2020 and beyond.

If you need additional help with general bookkeeping or a consultation on how to set up your 1099-NEC or 1099-MISC, feel free to contact me.